Resources now on the nose – banks rally (BHP, CBA, S32)

WHAT MATTERED TODAY

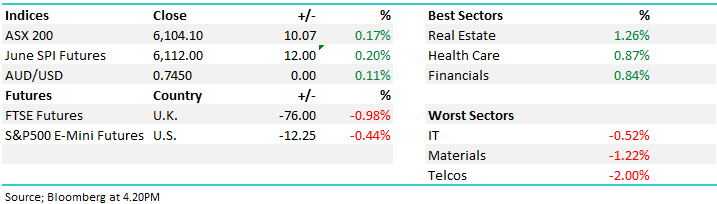

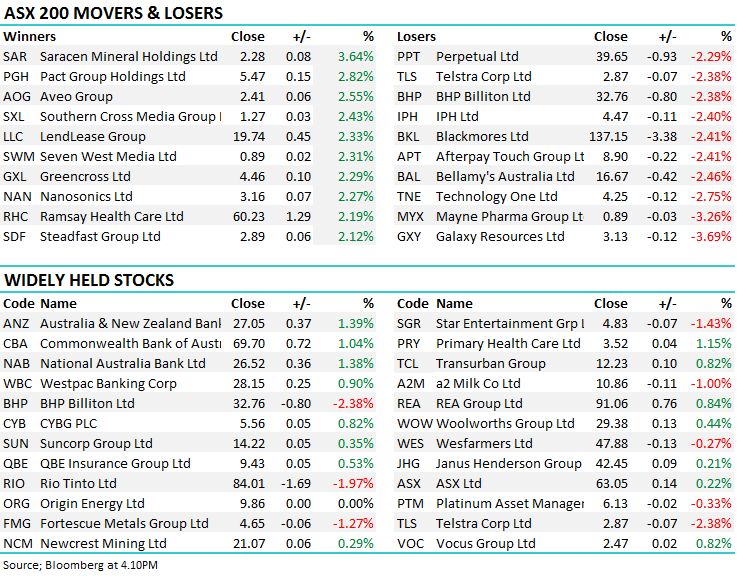

Friday saw a bullish day for Aussie stocks with the index rising strongly as coordinated buying across both the banks & resources played out, while today was a different story, resources were sold off while banks continued to rally (from a low base) – hence the index edged +10 points higher overall despite trade tensions overseas and weakness throughout Asia + selling in US Futures.

ANZ was the best of the banks adding 1.39% with NAB clipping at its heals up 1.38% followed by Com Bank and WBC. Combined the big 4 banks added +14 index point to the ASX 200 which tells the story of weakness across the broader market. BHP down -2.38% was a standout, although we did see some buying from intra -day lows. A few negative influences combining to hit commodity stocks at the moment – and we think there’s more to play out here, a topic we build on below.

Overall the ASX 200 index added +0.17% or 10 points to 6104 while the DOW Futures are trading down -116pts at time of writing.

I had a quick email from a subscriber today – Andrew Wielandt who is the Managing Parter at Dornbush Partners in Townsville. Whenever Andrew is in the big smoke we catch up. Andrew is in the US at the moment and wrote today…

Hi James – A good read, as always. Just a bit of backgrounding - I am currently in the US on an S&P study tour. We’ve done Chicago, New York and soon to head to Denver and Calgary (self funded I might add!). Interesting to note here, no one is talking recession. Everyone is “rah rah” about the US economy and are more worried about child immigration than the economy which seems to be booming. Just looking @ the Skyline, especially midtown NYC and it’s a crane-a-thon! Shoppers are madly consuming and everyone seems happy. Thanks AMW

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Iluka (ILU) in focus today with a positive note out from Macquarie saying that BHP Billiton’s decision to approve the development of the South Flank iron ore project will drive growth in Iluka’s royalty earnings from 2021 = net positive for ILU but stock not exciting here while the note from Citi on Transurban (TCL) is work a read – it fits in with our thinking that higher global interest rates may prompt an equity raising or lower payout plans given their big development pipeline…a topic we’ve covered in recent income reports.

Here’s the current broker calls….

· GUD Holdings Upgraded to Neutral at UBS; PT A$14.60

· Bapcor Downgraded to Neutral at UBS; PT A$7

· Primary Health Upgraded to Buy at Morningstar

· Rio Tinto Downgraded to Hold at Investec; PT 45 Pounds

· BHP Downgraded to Hold at Investec

South32 (S32); $3.85 / 1.28%; South32 has agreed to buy junior Canadian Zinc miner Arizona Mining for $1.75bil in cash, a huge 50% premium to the last traded price. South32 already holds 17% of the Toronto listed company, earning it a board seat and a close look at Arizona’s key asset, Hermosa, which holds zinc, silver and lead. The deal, although sizeable, doesn’t require South32 to raise debt, with enough cash on the balance sheet, however the asset is still in development phase and will require working capital to begin production. The purchase is positive given they know the business well however it has come at a cost – S32 paying well over market value it seems. We are negative South32 for its exposure to a range of base metals/commodities we don’t like – met coal being the biggest problem.

South32 (S32) Chart

Resource Stocks – why caution is warranted? Over the past 12 months BHP has rallied 45% while Commonwealth Bank (CBA) has fallen 15% before dividends. It’s clearly been a good year for resources however there are signs of weakness creeping in…a topic I wrote about in the Weekend Report however here’s a breakdown again of 3 key considerations playing into our thinking.

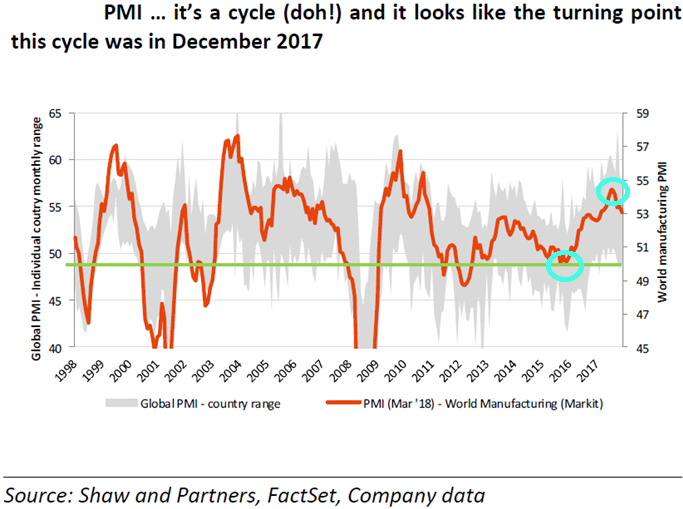

Global manufacturing data has peaked – for now. The long term manufacturing trends outline below highlight the cyclicality of global growth and importantly the key turning/inflection points that occur. The below chart goes back to 1998 however the two recent points of interest were in early 2016 and late 2017. The low in PMI’s in 2016 corresponded with the low in BHP at around $14 while we see clear signs that a high formed in December 2017, a clear negative influence on our local miners.

BHP is diverging versus the Emerging Markets; BHP has ignored major weakness in both crude oil and the emerging markets (EEM) over the last few weeks but todays move may just be the start of BHP starting to play catch up. The correlation between Emerging Markets and BHP is traditionally high, yet in recent weeks it has faltered. Warning No 2.

BHP v Emerging Markets Chart

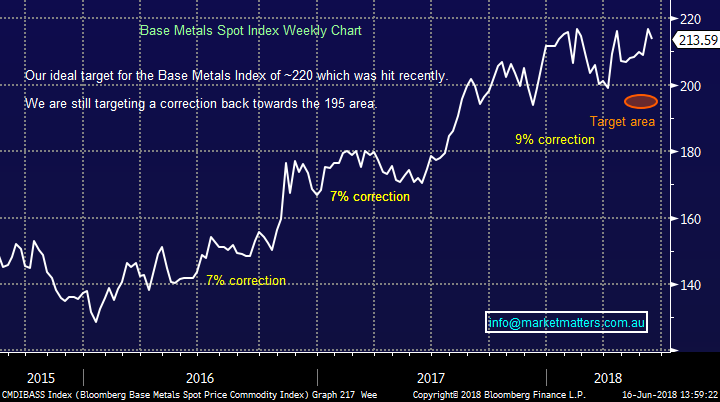

The Base Metals Index hit our upside target; For a number of weeks we have suggested from a simple risk / reward perspective we believe the most likely next 10% move by base metals is down. The base metals complex has hit resistance at a time when global manufacturing has entered a flat spot and stocks are diverging away from historical correlations. The direction of least resistance seems down.

Bloomberg Base Metals Spot Index Chart

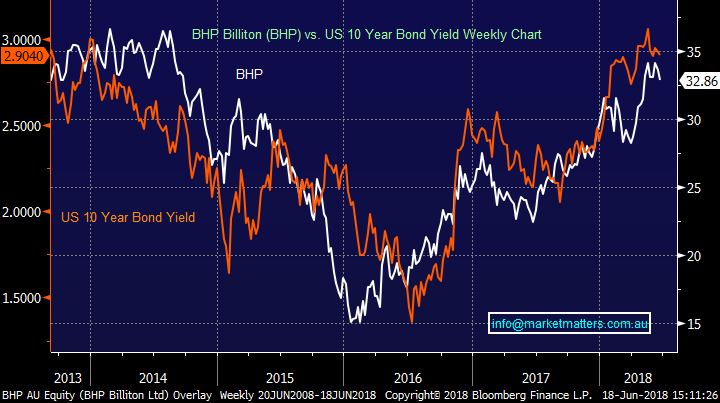

While these are 3 clear warning signs to sell resources, we will again become buyers into further weakness – the simple correlation between resource stocks and rising US interest rates is too hard to ignore.

BHP versus US 10 year bond yields

OUR CALLS

IGL was filled in the Income Portfolio today at $2.28

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here