Resource stock weigh ASX…

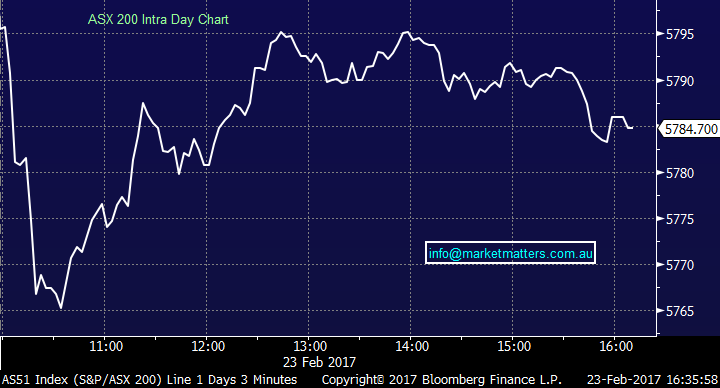

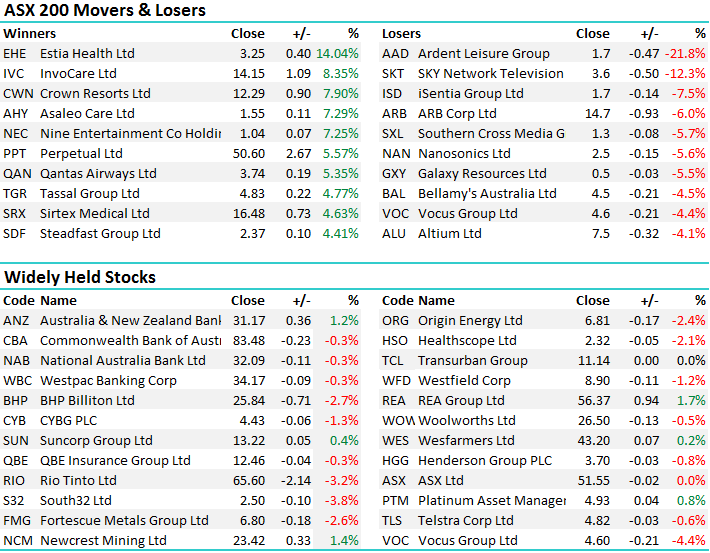

A huge day on the reporting front + it was stock options expiry so a very busy day on the desk…The market dropped sharply early on with a few large caps trading ex-dividend , but falling more (RIO an example here with the coy going ex for $1.63 but losing $3.78 or -5.45%) before a trepid recovery for the ASX from around 10.30 onwards. We had a range today of +/-31 points, a high of 5795, a low of 5764 and a close of 5784, off -20pts or -0.20%. As we wrote this morning; while our preferred scenario is the local market breaks over 6000 in 2017, before alarm bells start ringing, short-term we are now leaning towards the neutral / bearish camp looking for a reasonable pullback in the shorter term

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

When we sit back and analyse this reporting season at its conclusion, it’s likely to be flagged as a good one overall with the average revision to consensus earnings being slightly positive. Expectations were high leading in and for now the market in aggregate has delivered, largely a result of decent earnings by the banks, and a BIG increase in earnings from material stocks, many of which reported above expectations.

Delving down into specific themes though is more difficult once we get past the obvious ones. There’s no clear trend in terms of overseas earners, with a raft of mixed results there and the same can be said for the more domestically focussed operators. It seems to us, this reporting season is more about company specific factors than overall macro trends, and there has been a huge number of ‘landmines’ scattered around the place.

Today was no exception with a huge divergence in the performance of stocks reporting…

Ardent Leisure (AAD); Was the biggest loser on the ASX 200 today trading at a 3.5year low after a big write down ($93.6m) on its Dream World operations following the tragic accident last year. Revenue for AAD was only down around 5% for the year however their Aussie business is clearly struggling. For those ‘glass half full’ investors, their US operation is growing pretty well with top line revenue up +30%. Huge volume of shares through AAD today and it seemed that today’s result was the last straw. Shares closed down -21.76% to $1.69. We don’t own AAD.

Ardent Leisure (AAD) Daily Chart

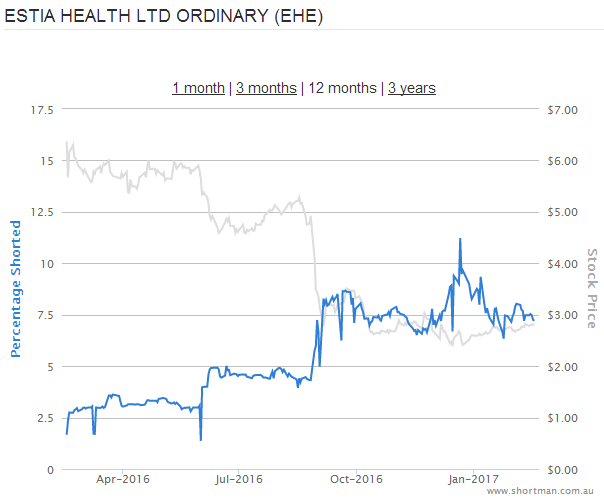

Estia Health (EHE); The market liked this result today pushing shares sharply higher after they re-confirmed guidance of between $86-$90 million, however the commentary around changes to the Aged Care Funding Instrument (ACFI) was of most interest. The company said "This will have minimal impact in the next reporting period, but will increase in significance as residents leave, and new residents enter, over the next three years." "We will continue to implement a range of strategies to mitigate this impact including increasing occupancy across the portfolio and increased and more targeted charging for additional services,"

As is often the case, the market gets too bearish a particular theme and Aged care was certainly in the firing line over the last 12 months. Some clearer air might in front of the stock from here and we’re seeing shorts start to cover.

Short interest in Estia Health is declining and no-doubt it would have gone done further today. The uncertainty in this stock sits around their ability to fill the void left by changing Government funding models, but probably more specifically, its more to do with what the Government will allow them to change in ‘other fees’. Estia (EHE) rallied +14.04% to $3.25. We don’t own Estia (EHE)

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here