Reporting Season Wrap: Diversified Financials & Insurance

DIVERSIFIED FINANCIALS Fund managers in the financials sector have been ‘hot’ as investors look for cheap leverage to a rising market, while some of the beaten down ‘sector dogs’ in the like of AMP and IOOF have moved up from their lows. Key points:

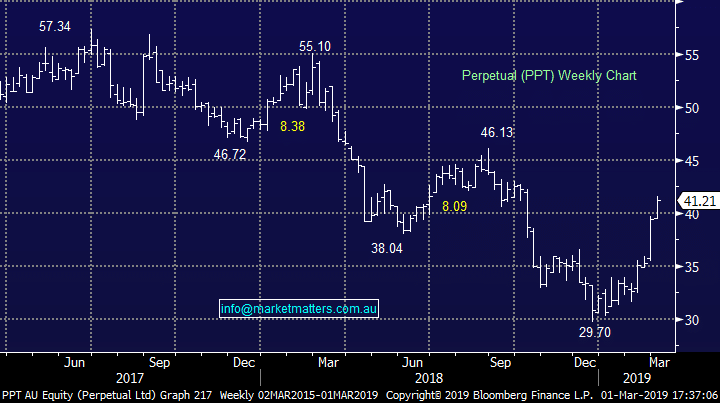

- Cheap stocks have been bought, Perpetual (ASX:PPT) has added 28% in the month and Janus Henderson (ASX:JHG) added 15%, however the higher quality operators like Magellan (ASX:MFG) have also jumped – up 25%

- Annuities provider Challenger Group (ASX:CGF) downgraded earnings blaming market volatility in the December quarter, however continued margin compression (the difference between the returns they guarantee to annuity holders and the returns they achieve by investing the money) remains a concern – this is a divisive stock and risks remain high

- Mortgage insurer Genworth (ASX:GMA) showed that while property is weak, actual mortgage stress and foreclosures are not yet a major issue across the country – GMA rallied ~20%

INSURANCE

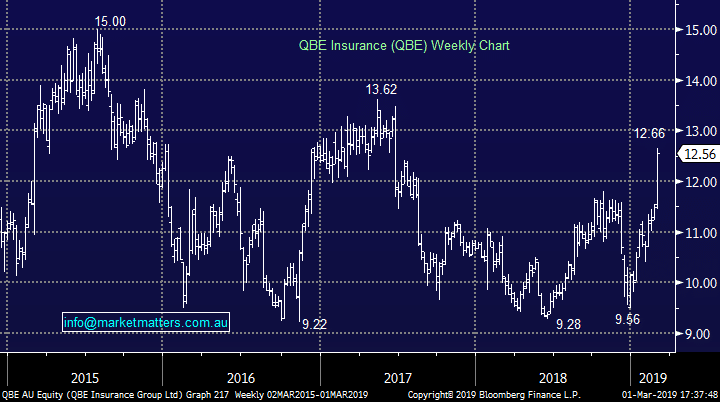

QBE’s international exposure helped rather than hindered this time around and it delivered a ‘clear’ set of results, and rallied as a consequence – the wayward ship is turning.

Key points:

INSURANCE

QBE’s international exposure helped rather than hindered this time around and it delivered a ‘clear’ set of results, and rallied as a consequence – the wayward ship is turning.

Key points:

- Insurance remains tough, although tougher in Australia than overseas it appears

- Suncorp’s banking division was soft and that hurt their result

- IAG (and SUN for that matter) have strong capital positions & further capital management is likely