Reporting season rolls on with plenty of volatility under the hood (TCL, CGF, MQG)

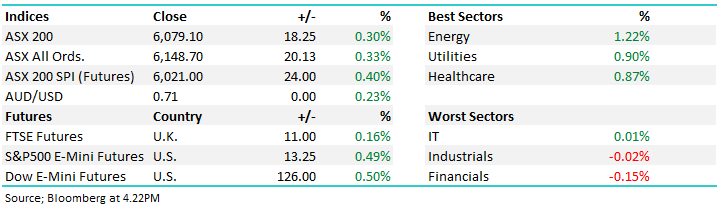

WHAT MATTERED TODAY

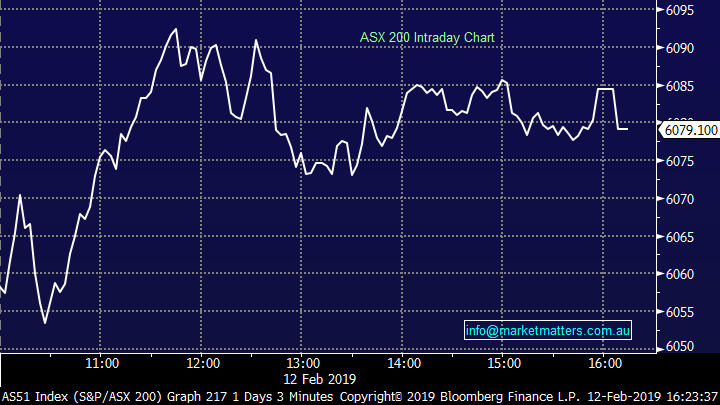

Sellers tipped into the market early today however the weakness was short lived as news trickled across the Bloomberg that a tentative deal had been struck on border security (aka the Wall) that would avert a second government shutdown. That saw US futures rally +0.50% and our market put on a quick +30 points before lunch ahead of a fairly quiet afternoon session.

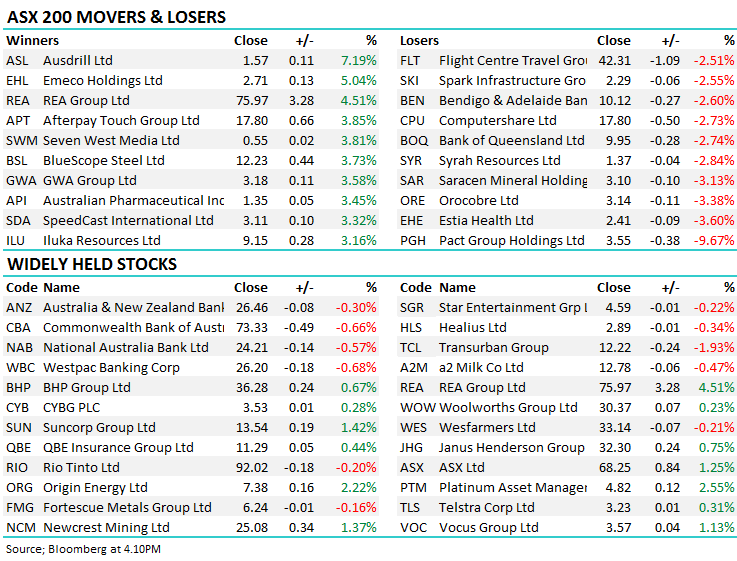

Consumer confidence data was weak before open today however the 11.30pm print on housing was more important, and it was soft with home loans printing -6.1% MoM versus a decline of 2% expected.Weakness in credit persists and that saw some sellers come back into the banking stocks – Bendigo (ASX:BEN) hit another -2.6%, BOQ down -2.74% while CBA fell by 0.66% before trading ex-dividend tomorrow.

Aussie Economic Data

It was actually a pretty soft session locally considering the positive move in US Futures, during our time zone + we saw a strong move in Japan that was trading up around +2.5% at our close – perhaps the ~3% outperformance in Oz from last week is starting to look extreme!

Overall, the ASX 200 closed up +18points or +0.30% to 6079. Dow Futures are currently trading up +119pts or +0.48%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

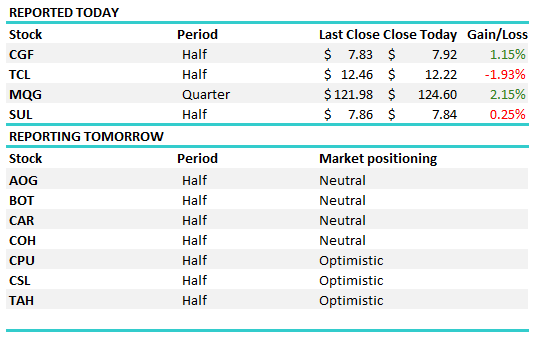

Reporting; Another volatile day for companies reporting and a busy one on the desk - Harry only had a chance to run the numbers on Macquarie (below) while I provided a quick take on Challenger & Transurban.

Challenger Group Financial (ASX:CGF) +1.15% which had obviously downgraded at the end of January, so there was no real headline risk in today’s 1H result - however the detail was important, and created some decent volatility in the stock.

It was initially sold off hard from $7.83 down to a $7.35 low before it rebounded fairly strong back up to ~$8 before closing at ~$7.92. We sold CGF recently for a loss, a pretty painful one however the reason for the sale still stands post todays numbers. The product cash margin is down by 17 bps from 2.12% in 2H18 to 1.95% in 1H19, which is the continuation of a trend. While the company says its reducing its risk profile on its investment portfolio, at the same time its increasing its capital growth assumption on that portfolio which doesn’t really make sense. In terms of actual growth, life annuity flows have fallen significantly and annuity book growth during 2Q19 was 1% which is the lowest growth rate for some time. We’d question why they maintained the dividend when the business is under some pressure.

Challenger Group Financial (ASX:CGF) Chart

The toll road operator Transurban (ASX:TCL) -1.93% was also out with 1H19 numbers, and at the revenue line they were around 3% light versus expectations and about 4% at the EBITDA line, however they did maintain full year dividend guidance of 59cps which is positive, given it’s often considered a bond dressed up as an equity. There was actually some in the market thinking a cut to the dividend would happen given the big pipeline of work in both WestConnex and NorthConnex, the latter of which has now been delayed from this year to some stage in 2020. The market thought Q1 next year was a possibility however it now seems that’s optimistic. From a stock perspective, the big rally in global bonds which has put pressure on yields has helped TCL rally from October onwards, however at this point in the cycle, we have no interest.

Transurban (ASX:TCL) Chart

Macquarie (ASX: MQG) +2.15%; The bank rallied on an operational update today showing performance has been strong 3 quarters through the year with Macquarie looking at an ‘up to 15%’ increase in profit for the year which is slightly behind the consensus view of 18% profit growth but inline with their prior guidance. For the quarter, Macquarie has seen the market’s facing business drive performance with Macquarie Capital & Commodities and Global Markets rebound from more muted year in FY18. The asset management business has shrunk in the financial year to date, however some larger transactions in the asset finance and banking divisions have helped to offset the fall.

The fall in asset management revenues has been attributed to poor market conditions which saw a 2% fall in assets under management (AUM) in the quarter and a slide in performance fees to be charged. As always, Macquarie’s guidance included the caveat of “future market conditions makes forecasting difficult” – somewhat ironic from an investment bank, but always leaving room to surprise to the upside at the full year result.

Macquarie (ASX: MQG) Chart

Broker Moves; Goldmans say that RIO is the only major producer able to substantially increase iron ore volumes amid disruptions caused by Vale SA’s disaster in Brazil, which underpinned a downgrade on BHP & Upgrade to RIO today

BHP Group PLC Downgraded to Neutral at Goldman

· Rio Tinto Upgraded to Buy at Goldman

· Coronado Global GDRs Rated New Buy at UBS; PT A$3.60

· GPT Group Downgraded to Neutral at Macquarie; PT A$5.99

· GPT Group Downgraded to Sell at Citi

· Viva Energy Group Rated New Outperform at Macquarie; PT A$3.25

· Aurizon Upgraded to Neutral at Citi; PT A$4.40

· Aurizon Upgraded to Equal-weight at Morgan Stanley; PT A$4.50

· Aurizon Downgraded to Neutral at Macquarie; PT A$4.45

· Bendigo & Adelaide Downgraded to Sell at Citi; PT A$9.50

· Bendigo & Adelaide Cut to Underperform at Credit Suisse; PT A$10

· Coats Rated New Reduce at HSBC; PT 70 Pence

· Healius Upgraded to Neutral at Evans and Partners; PT A$2.88

· Transurban Downgraded to Sell at Morningstar

· Nufarm Upgraded to Buy at Morningstar

· Charter Hall Long Upgraded to Neutral at JPMorgan; PT A$4.25

· Amcor Downgraded to Neutral at Credit Suisse; PT A$14.90

· Vocus Upgraded to Overweight at Morgan Stanley

· OZ Minerals Reinstated Equal-weight at Morgan Stanley; PT A$11

· Spark Infrastructure Cut to Neutral at JPMorgan; PT A$2.50

OUR CALLS

No amendments today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.