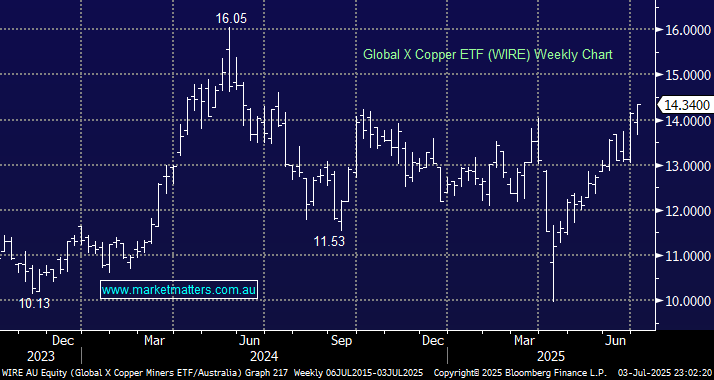

ETF Friday: Using ETFs to ride the resources rally

The ASX 200 finished unchanged on Thursday, but on the stock level, it was a very different story, with the materials sector surging over 3% while 8 of the mainboard 11 sectors retreated, including the financials, which fell 1.3%, a very different story to the last 18 months.