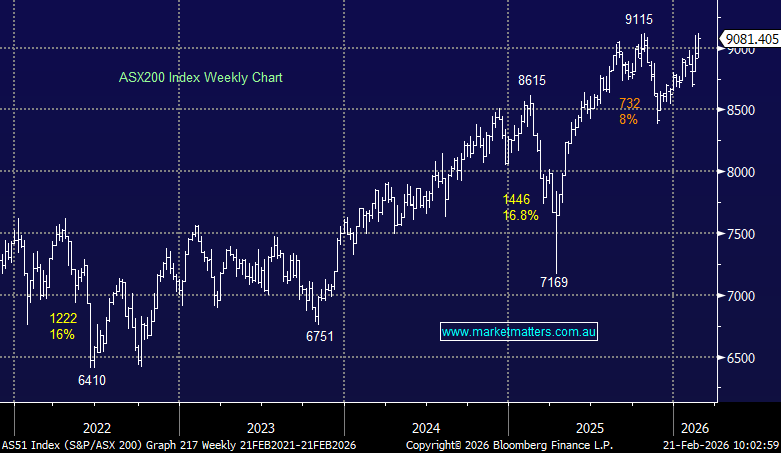

Earlier this month we saw the RBA hike rates by only 0.25% when most pundits thought they would go 0.5%, over the last 2-weeks slowly but surely the markets are starting to embrace the possibility that bond yields are close to an inflection point and the inversely correlated rate sensitive stocks/sectors a bottom e.g. Tech, Consumer Discretionary and Real Estate. At MM we’ve stuck to our contrarian view that equities will be higher come Christmas, led by the high Beta Tech Sector, and yesterday we saw how easily some of these stocks can pop when sentiment turns, only slightly: