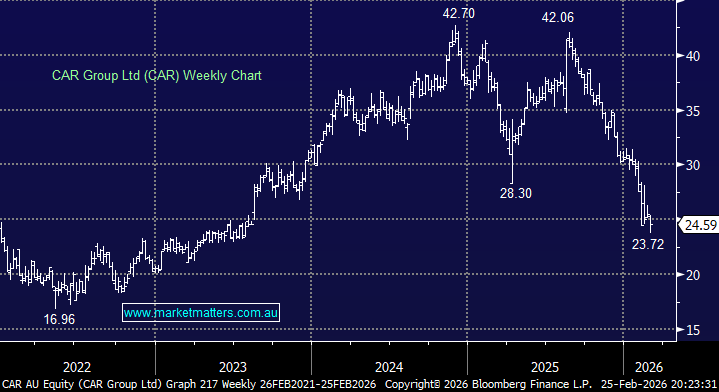

RBA remains accomodative (RIO, COH)

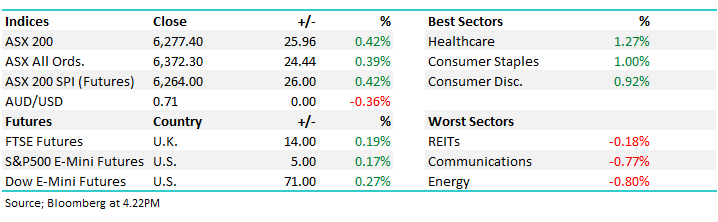

WHAT MATTERED TODAY

The ASX brushed a weak overnight futures read early in the session as the banks caught a bid for the third day in a row. The buying caught a second wind mid-morning around the time of the RBA Minutes release. There was a significant change in tone from the RBA board with central bank pondering what it would require to move to cutting rates. Despite not seeing any need to drop rates in the short term, house prices continues to get a mention with the weak housing market having a significant impact on spending despite strong employment data which has been supporting the local economy. The RBA also called out the currencies impact on inflation with the preference for a lower dollar to help activity pick up – traders saw this as an opportunity to sell the AUD but buy the ASX and there was some strong intra-day moves around the release at 11.30AM.

AUD/USD Chart

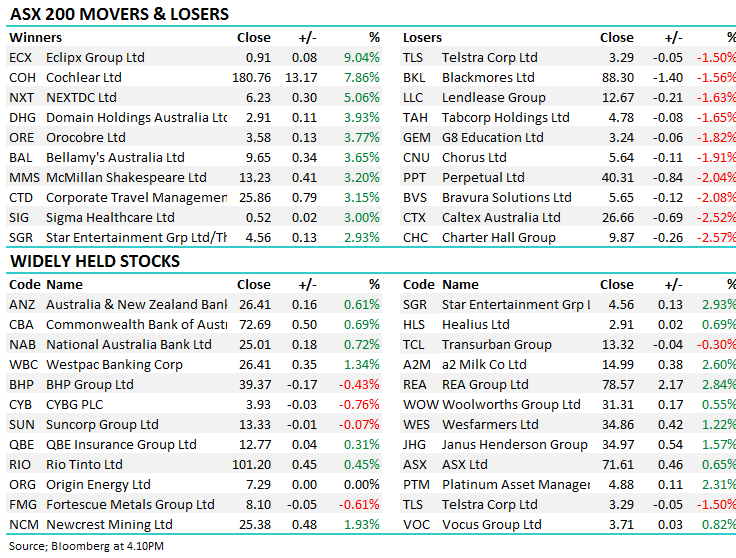

On a sector level, the consumer facing stocks saw some buying on the back of the RBA comments, however it was healthcare which again took out top spot thanks buying in heavyweight Cochlear (COH) – we look at why they moved higher today later in the report.

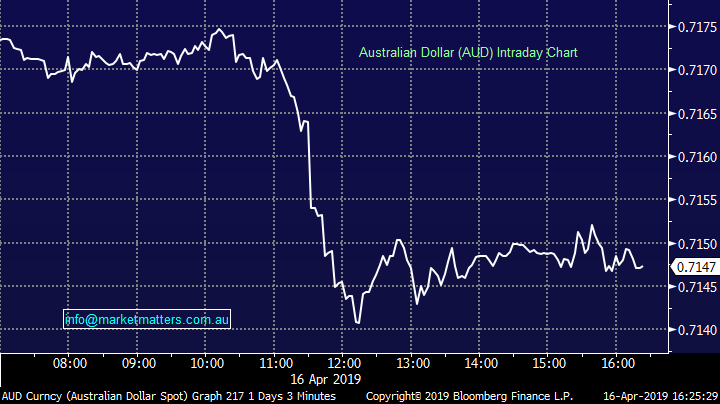

Overall today, the ASX 200 up 26 points or +0.42% at 6277. Dow Futures are trading higher, up +71pts / 0.27%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

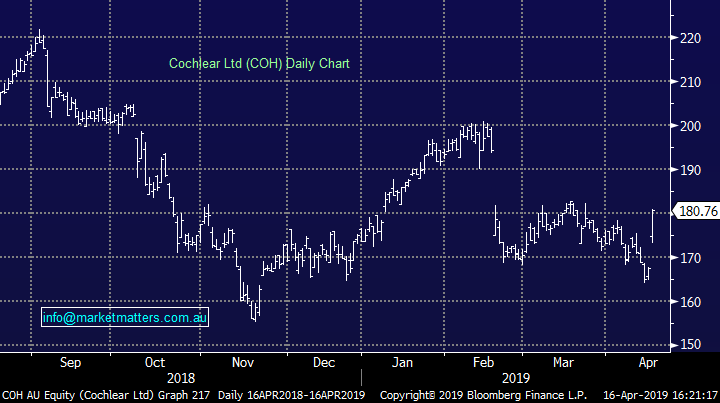

Cochlear (COH), +7.86%, tested and held the $180 level today thanks to a new product hitting the market. The Nucleus Profile Plus range is an advancement on some of its current range and is now available in Germany while Cochlear await regulatory approval to expand the offering globally. The new product allows patients to have an MRI without the need to remove the core parts of the device. We are on the sidelines here, selling prior to the half year result which saw the stock tumble soon after – the market now buying back into the growth story here with a large addressable market and a clear foothold in the quality end of the hearing space it is certainly a quality stock which can be bought for the right price.

Cochlear (COH) Chart

Rio Tinto (RIO), +0.45%, traded only marginally higher today, but well outperformed other iron ore names which traded lower, on the day RIO posted its quarterly numbers. Iron ore production was impacted by the cyclone which tracked over Western Australia late in the quarter and Rio was forced to lower production guidance again as a result. However this was the only blip on the scorecard, and one the market was expecting given the recent change in tone around guidance. Copper, aluminium & mineral sands production, among a number of other products, are all tracking well and no changes to any other guidance. We do like Rio but find it hard to buy in at these levels. We recently wrote “this a market with many strong driving fundamental issues with the previously mentioned Vale supply the most important this year, sharp 10-20% pullbacks is almost common for the commodity and it could easily be far more if Vale were to just hint at returning some decent supply in the future – our ideal buy price for iron ore is ~15% lower, from a risk / reward perspective we cannot chase at today’s prices.” – Read the full iron ore report here.

Rio Tinto (RIO) Chart

Broker Moves:

· Fortescue Downgraded to Reduce at HSBC; PT A$7.30

· Regis Resources Upgraded to Outperform at Macquarie; PT A$5.60

· Platinum Asset Upgraded to Neutral at Macquarie; PT A$4.85

· Perpetual Downgraded to Underperform at Macquarie; PT A$38

· Automotive Holdings Raised to Outperform at Macquarie; PT A$2.65

· Hansen Tech Rated New Outperform at RBC; PT A$3.75

· Mayne Pharma Upgraded to Buy at Wilsons; PT A$0.75

· Pendal Group Cut to Neutral at Evans and Partners; PT A$8.29

· Automotive Holdings Upgraded to Buy at Bell Potter; PT A$2.70

· CYBG Downgraded to Hold at Investec; PT 2.30 Pounds

OUR CALLS

No changes to either portfolio today.

Have a great night!

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.