RBA extends a very boring record, the banks sell off (NUF, WBC)

WHAT MATTERED TODAY

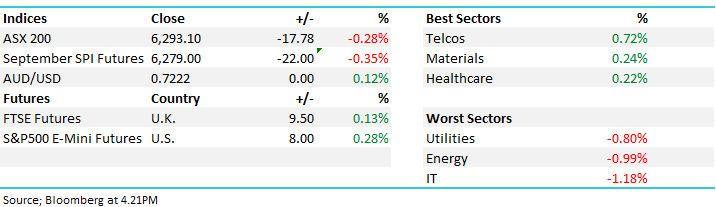

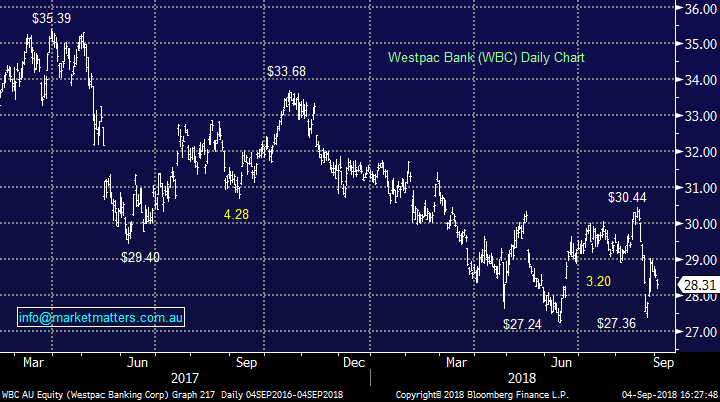

Today it was the bank’s turn to send the market well off the day’s highs, but also well off the day’s lows. Futures were sold off early, the index followed once it opened and the market spent most of the day trading back below 6300. The RBA was unwavering in its stance of rates at 1.5%, now extending to 25-months on hold – in our view, the next move will be higher, but are unsure of the timing. Westpac’s decision to hit loans with an out-of-cycle hike will likely delay the RBA’s need to raise rates, particularly if the other banks follow suit. The dollar squeezed higher on the news, a sign that a lot of money is short the Aussie. The trend certainly remains to the downside, however a short term bounce would not surprise given the markets positioning around our currency.

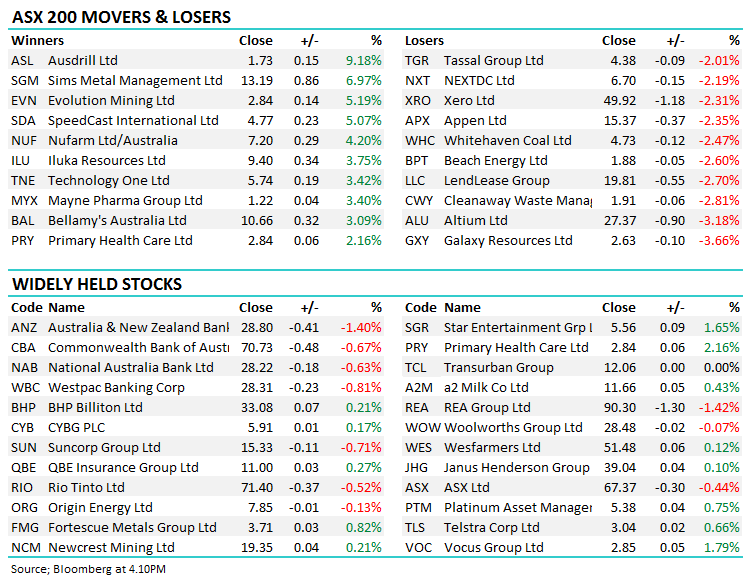

Orocobre remained in a trading halt for the session today whilst drawing up a market announcement in relation to Argentinian export taxes, proposed in an effort to help with the government’s soaring debt position. Elsewhere Suncorp announced it will receive $725mil for the sale of its life insurance unit to Japan’s TAL Dai-chi and plans to return $600mil of the proceeds to shareholders – more detail on how will be revealed once the transaction is complete later this year. From outside the top 200, Kogan fell a huge -8.96% to $6.40 after another round of selling by founders Ruslan and Shafer. The pair sold another $40 mil worth of shares in a block trade at $6.41 but did say this would be the last round of selling from the pair at least until the half year result in February.

Overall, the index closed down -17 points or -0.28% today to 6293.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

- ClearView (CVW AU): Rated New Buy at Blue Ocean; PT A$1.50

- Zenitas (ZNT AU): Zenitas Downgraded to Hold at Wilsons; PT A$1.46

Nufarm (NUF) $7.20 / +4.2%; Herbicide producer Nufarm has jumped today on news that Brazil had overturned its ban on glyphosate products despite the continuing review into products that contain the chemical. Glyphosate is common in many weed control products, including Roundup, and came under fire after a US court ruled in favour of a cancer suffer who took Roundup to court claiming that the chemical had contributed to the disease.

Before this court case, Nufarm had come under pressure from the Australian drought which forced it to downgrade guidance back in July and had fallen -34.7% from a June high of $9.60 to an August low of $6.27 when fears peaked on glyphosate bans and drought impacts were factored in. The bounce back for Nufarm has been impressive highlighting why buying agriculture stocks into weather related issues holds credit.

Nufarm (NUF) Chart

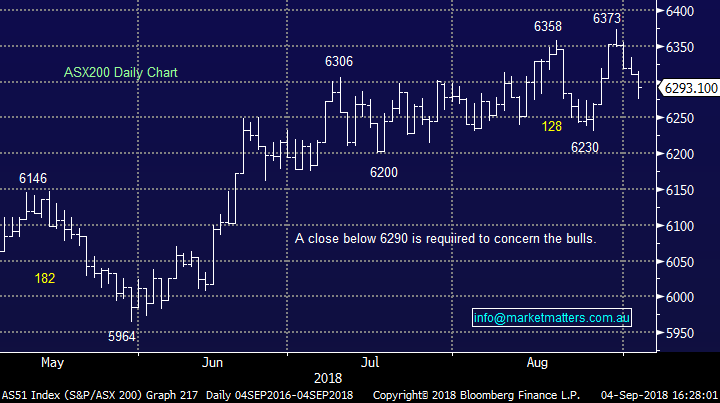

Westpac (WBC) $28.31 / -0.81%; Westpac caved to ASIC today, accepting a $35 mil penalty for breaches to the Consumer Credit Protection act on 50,000 approved loans. The breaches related to an automated system which didn’t factor in the applicants declared expenses, but rather used the Household Expenditure Measure benchmark which has been found to grossly underestimate many peoples weekly expenses. The breach also relates to the calculation of repayments after the interest only period expires on owner-occupier loans. The review found that over 10,00 loans in question should not have been approved.

The penalty, if approved by the Federal Court, will be the largest under the national Credit act although it would represent a drop in the ocean to Westpac. It does however highlight the growing regulation and monitoring of the big banks. All the banks were notably lower today.

Westpac (WBC) Chart

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.