RBA expects a 10% contraction in the 1st half (BHP)

WHAT MATTERED TODAY

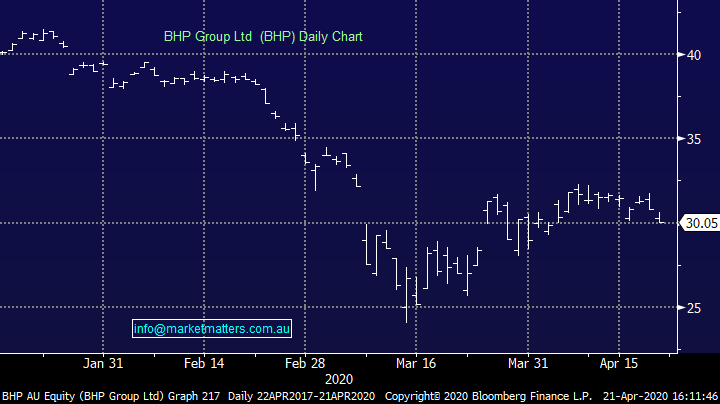

The market opened lower this morning, although not materially so, however as the day-built steam, so too did the sellers and we closed near enough to session lows. The IT stocks gave back yesterday’s outperformance falling by nearly 5% while CSL fell fairly hard for its second straight session. We covered CSL this morning however it’s starting to feel very heavy. Elsewhere, BHP was out with production numbers that were okay, Harry covers below while the energy stocks were a focal point after front month Crude traded in a negative market overnight, while that garnered a lot of attention the local energy sector fell by -2% today, better than the boarder market, a -1.29% decline by Woodside (WPL) not a bad effort.

The RBA minutes were released this morning (11.30am) while Governor Lowe gave a speech at 3pm...the high notes being they expect the economy will contract 10% in the first half, which would be the biggest contraction in output since the 1930’s, while they forecast unemployment to be above 6% for the next couple of years. "As the economic data roll in over coming months, they will present a very sobering picture of the state of our economy." He talked about the likely recovery saying one scenario was that is starts to bounce back in the Sep quarter and it would build from there. "Whatever the timing of the recovery, when it does come, we should not be expecting that we will return quickly to business as usual. Rather, the twin health and economic emergencies that we are experiencing now will cast a shadow over our economy for some time to come."

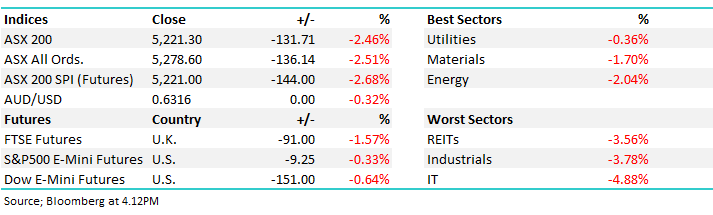

Today the ASX 200 fell -131pts /-2.46% to close at 5221 - Dow Futures are trading down -151pts/-0.65%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

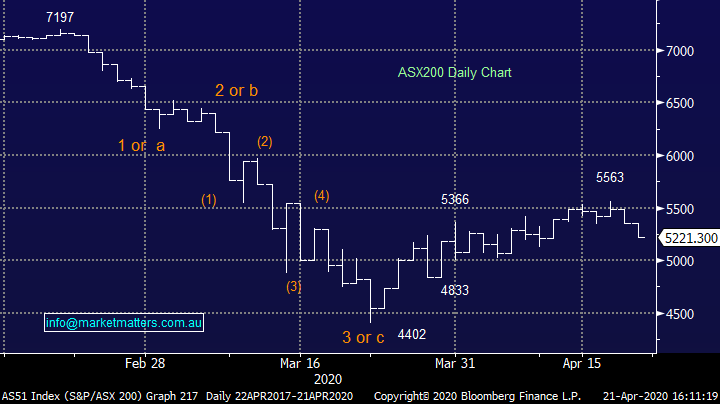

BHP Group (BHP) -2.5%: traded largely in line with peers and the broader index today after posting a reasonable set of 3rd quarter production numbers. Production was down on the second quarter across the commodity deck as is normally the case given the seasonal headwinds faced, though numbers seemed a tad light on for petroleum & coal in particular while iron ore & copper were better than the same quarter last year. Costs were all within guidance.

BHP also provided some commentary on what they are seeing from the demand side noting the various impacts of COVID-19. According to the miner, China is back to running near full pace, supporting iron ore demand while copper has seemed less of an impact ex-China. They noted oil storage capacity would likely become an issue, as it did overnight. BHP has softened its approach to its growth projects, pinning CAPEX back and is likely to guide spending lower into next year. Mostly though the company is in good shape and has plenty of liquidity across its balance sheet. Two factors remain key though, ensuring mines continue to run and demand starts to pick up again. We like & own BHP.

BHP Chart

AUSBIZ THIS AM: I was on AUSBIZ (www.ausbiz.com.au) this morning, and will be going forward - this is a new live streaming service. I’m on Tuesday mornings and Thursday’s around 11 however will try and include in PM notes when I can. Today’s update looks at Oil + Virgin + BHP Production – click here

BROKER MOVES:

- Centuria Office REIT Raised to Buy at UBS; PT A$2.50

- GPT Group Raised to Buy at UBS; PT A$4.70

- Metcash Cut to Neutral at UBS; PT A$2.85

- Vicinity Centres Raised to Outperform at Macquarie; PT A$1.70

- Scentre Group Raised to Neutral at Macquarie; PT A$2.18

- Metcash Cut to Neutral at JPMorgan; PT A$3

- South32 Cut to Neutral at Macquarie; PT A$2.40

- Metcash Cut to Hold at Jefferies; PT A$3

- Northern Star Cut to Underweight at JPMorgan; PT A$11.20

- Evolution Cut to Underweight at JPMorgan; PT A$3.70

- OceanaGold GDRs Cut to Neutral at JPMorgan; PT A$2.20

- Mader Group Rated New Buy at Bell Potter; PT A$1.10

- Xero Cut to Sector Perform at RBC; PT A$75

OUR CALLS

No changes today

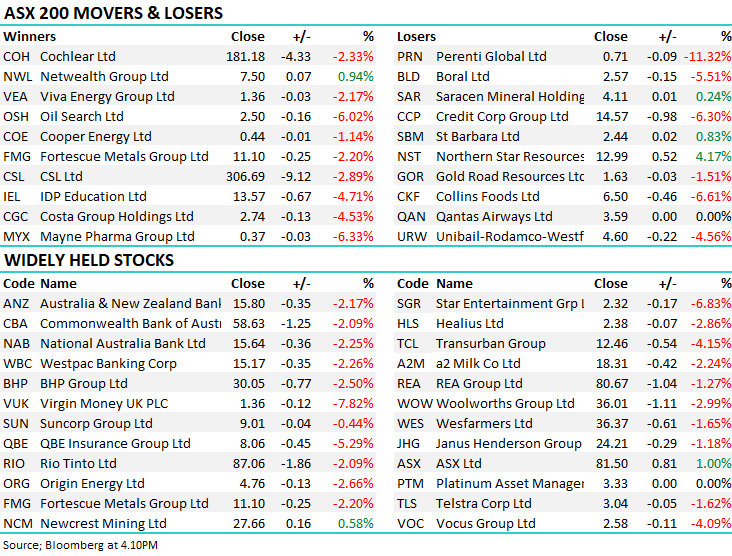

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.