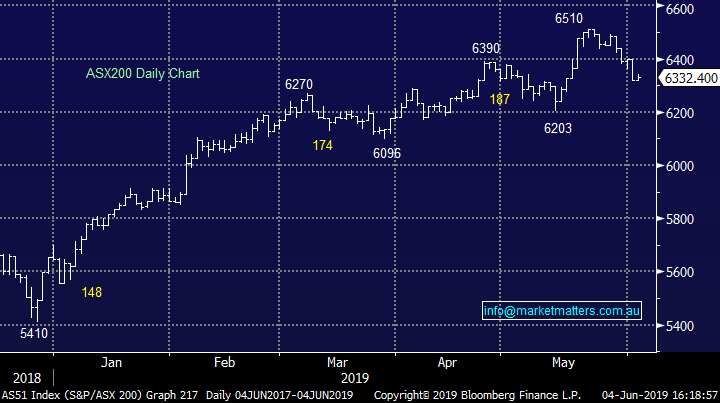

RBA acts for the first time in 33 months – cuts rates (A2M, CCL)

WHAT MATTERED TODAY

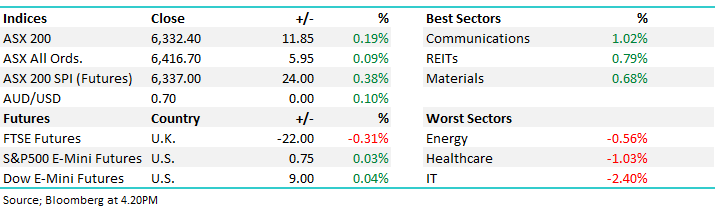

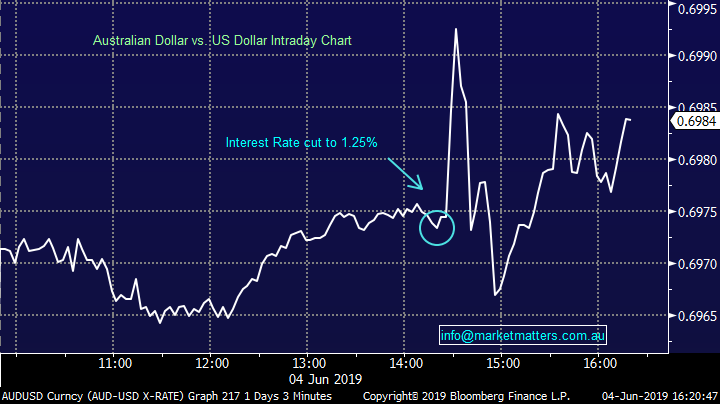

A choppy session for the ASX today as traders positioned ahead of the RBA rates decision at 2.30pm this afternoon, with Philip Lowe & the board ending the longest streak of inactivity in history, lowering the Australian cash rate by 0.25% to 1.25%. The RBA had sat on their hands for 33 straight months, however a combination of weak inflation and slack in the Labour market prompted todays move. After the announcement, the AUD actually rallied while stocks also edged higher, however the fairly muted reactions implied that most, if not all of the move was already baked in.

On inflation, the board said…“The recent inflation outcomes have been lower than expected and suggest subdued inflationary pressures across much of the economy. Inflation is still however anticipated to pick up, and will be boosted in the June quarter by increases in petrol prices. The central scenario remains for underlying inflation to be 1¾ per cent this year, 2 per cent in 2020 and a little higher after that.”

On the Labour market the board said …“The Board will continue to monitor developments in the labour market closely and adjust monetary policy to support sustainable growth in the economy and the achievement of the inflation target over time.”

“The strong employment growth over the past year or so has led to a pick-up in wages growth in the private sector, although overall wages growth remains low. A further gradual lift in wages growth is expected and this would be a welcome development. Taken together, these labour market outcomes suggest that the Australian economy can sustain a lower rate of unemployment”

In short, they cut rates however they were probably more upbeat about inflationary expectations & the employment situation than they could have been. While the bulk of the market was expecting the RBA to cut rates today, and they delivered, the focus will now turn to a potential cut in August. ANZ have passed on 0.17% of the cut, while CBA has passed it on in full.

AUD Chart

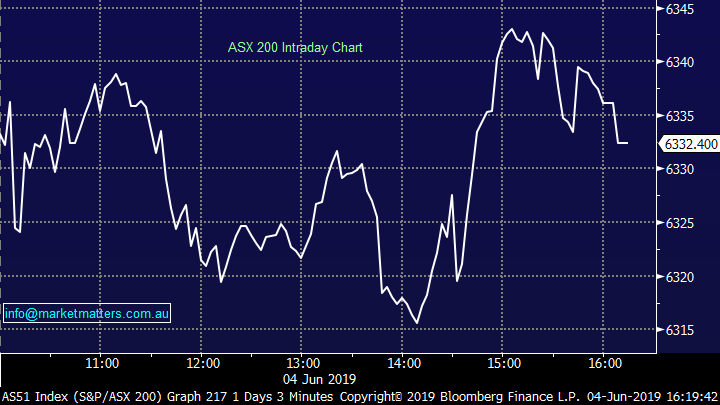

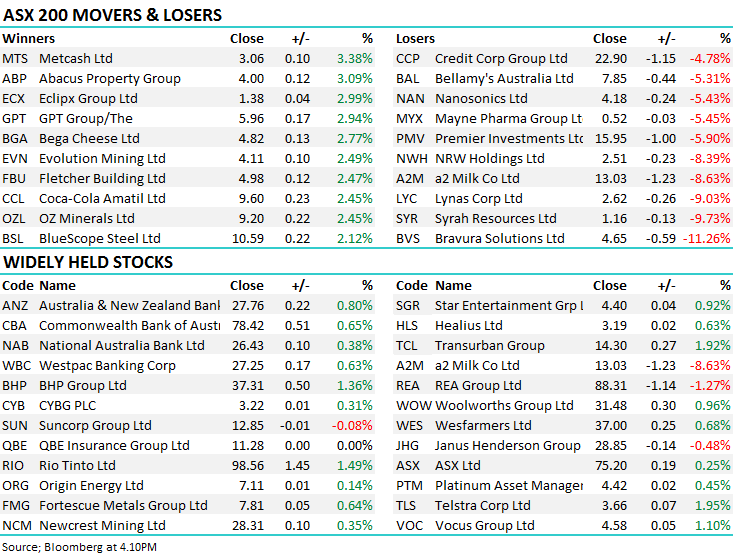

Overall today, the ASX 200 added +12 points or +0.19% to 6332. Dow Futures are trading up +15pts / +0.06%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Baby formula stocks: The listed companies selling baby formula into China have been cleaned up today after the country announced targets to become 60% self-sufficient in the market in what signals a turning point in what has been a lucrative strategy for the ASX listed cohort.

The message has come from China’s national Development and Reform Commission which recently pinpointed baby formula as an important product and is developing strategies to help local producers, as well as refocus the customer on China made products. A2 Milk (A2M), Bellamy’s (BAL), bubs Australia (BUB) and Wattle Health (WHA) have all been under pressure since the report was released.

A2 Milk (A2M) Chart

Coca-Cola Amatil (CCL) +2.45%; Australia’s licensee of Coca-Cola products has today ended its tumultuous ownership of the iconic Australian fruit and veg company SPC, selling it to a partnership between fund manager Perma & family office/ Private equity name The Eights. The deal was done for $40m, a long way from the Coca-Cola Amatil’s $490m purchase price. CCL has also tipped another ~$200m into SPC since picking it up back in 2005, but has slowly been forced to write-down the asset to near nothing over the years. So much has been written off SPC that Coca-Cola will book a profit in the deal despite paying more than 10 times the price they are set to receive.

CCL has some headwinds as people look for healthier options, although the company has done a good job of diversifying away from the sugary drinks market and as a result seen sales rise accordingly. The company has done well to extract any value out of the sale, and may now see some benefits in the share price as a result.

Coca-Cola (CCL) Chart

Broker moves:

· Carsales.com Downgraded to Neutral at UBS; PT A$14

· Metcash Upgraded to Hold at Deutsche Bank; PT Set to A$2.80

· Newcrest Downgraded to Sell at Morningstar

· Perpetual Upgraded to Hold at Morningstar

· G8 Education Upgraded to Buy at Morningstar

· Reliance Worldwide Upgraded to Buy at Morningstar

· Macquarie Group Upgraded to Buy at Morningstar

· Santos Upgraded to Buy at Morningstar

· Abacus Property Rated New Outperform at Credit Suisse; PT A$4

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/06/19

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.