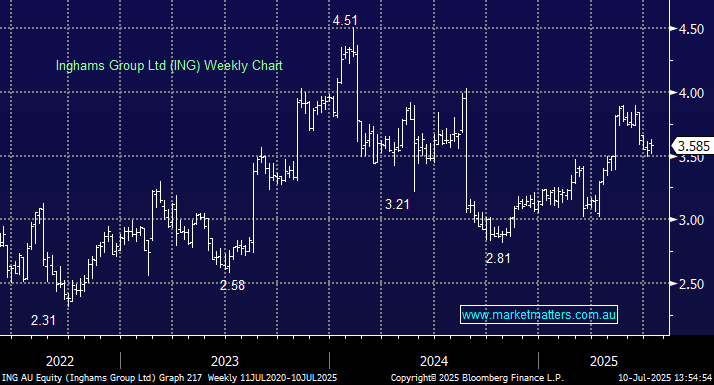

Your further thoughts on Helia Group (HLI) and Inghams (ING)

Dear Team, I was at first excited when you put HLI into your Income Portfolio. However, when I studied the stock a bit and read your comments I became uneasy. It seems most analysts think it will hit about $3.50 as a 12 month target and yet it is WAY beyond that even now. It has lost 60 % of it's business and will be seeking a new CEO. It seems that a hell of a lot of things have got to go right to be a winner and only a few things need to go wrong to be a loser. Also, today ( 09/07'25) Trump shook up the world markets with his tariff threats and the rate cut did not come through yesterday and yet this stock went up 4% today. Why? I also note it is only 2 1/2 % of the Income Portfolio and it is rated as high risk. And yet it climbs and climbs. I have a feeling of deja vu as in Whitehaven Coal or ORI in another portfolio. I KNOW you have discussed this stock several times in the past 2 weeks. A 4% rise when Trump is stirring the pot seems very odd to me. Your further comments would be very much appreciated. ING seems to have come back a bit, but, does not look like there is any growth left. It's dividend attracts me , but, I want a little growth, too, to keep up with inflation. Do you think it might be a value trap or maybe it just does not have much potential as a company? Thank you for your ALWAYS wise words of wisdom. I am NOT seeking advice as to whether or not to buy these stocks; I am only seeking more data and more reasons for current events. Octogenarian