Xero (XRO), WiseTech Global (WTC) and growth stocks

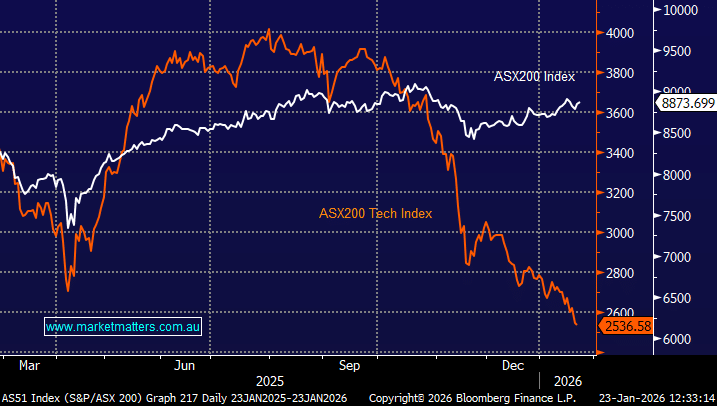

As I type this, XRO hit a low of 98.66. Almost 50% drawdown from its peak of 196. This is a great business, but great business dont fall 50%. Where do you see this going? Do you see recovery? Same Question for WTC, where do you see this going. I am aware the whole tech sector sentiment is down, but 50% drawdown is huge. Thoughts please

Hi Xero share price continues to decline, I notice that of the TradingView data shows 11 out of 14 analysts have a buy or strong buy rating on the ASX shares. The maximum target price is a huge $228.45 a piece, which implies the shares could jump 130.99% over the next 12 months, at the time of writing. At circa $97.00 today this seems very bullish. You guys seem positive?. Anything else I’m missing on this stock. Steve

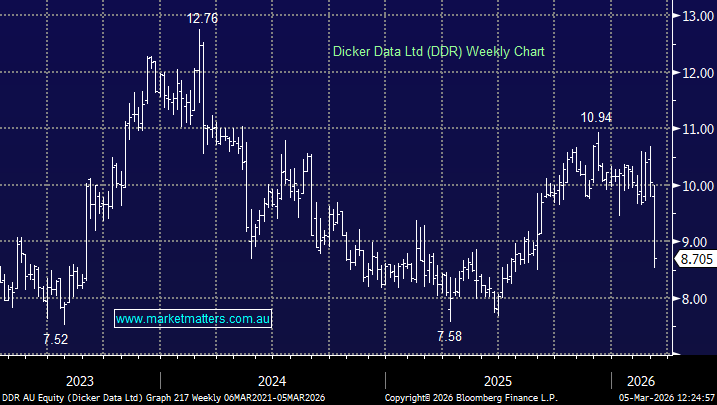

Hi James & Team - What's your current view on these growth stocks? Would you be buying Catapult, WiseTech & Xero now or do you see further falls in their share price? (Mid Dec one of Shawn's trade ideas was -"Trade Idea: Buy Catapult Sports Ltd (CAT) at $4.04 with initial stops at $3.60 – 11% risk." It was trading at $3.63 on Thursday. regards Debbie

Team, Happy New Year. I was interested in your outlook for CAT as it has been volatile early in 2026. Regards Jeff

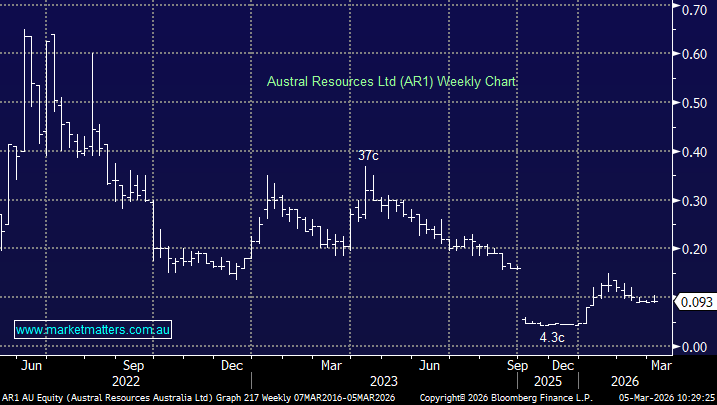

Gents As you well know the Aus tech sector has been soft. In aggregate down something like 20% in 3 months. Some stocks down a lot more on an individual level. Q - what are your thoughts on something like ATEC? It looks appealing given the spreading of risk over a portfolio of names. Or would you prefer to hand pick a few names and go that route (assuming you think our tech names are looking more attractive - which I think you have been suggesting). Tnx Matt