Hi Guys,

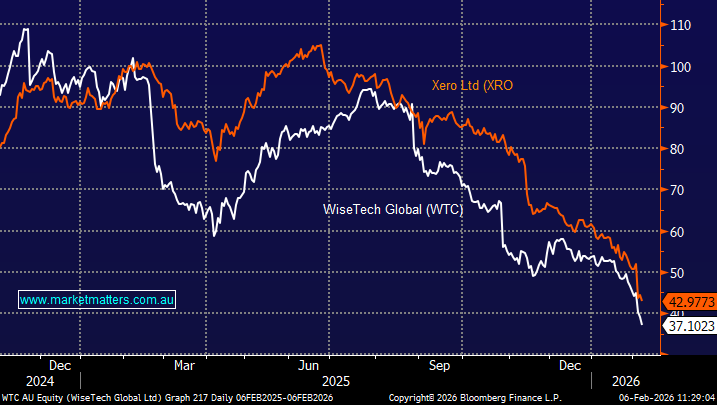

We wrote about these two stocks on Thursday when we revisited the AI risks around the software end of town, here: WTC and XRO.

We believe these are two quality businessess in the middle of a 2-pronged storm:

- AI disruption fears are washing through global software businesses aggressively contracting valuations as the equity risk premium (ER) rises.

- Plus, they have both made major acquisitions in the last 12-months which brings with it uncertainties around efficient and cost-effective synergies into the underlying businesses, especially considering Xero paid $US2.5bn for Melio and WTC $US2.1bn for e2open’s Strategic Logistics business.

While we believe both are oversold, as we thought 10-20% ago, it’s going to take time for these fears to play out during the AI revolution.

AI can help companies build software faster, but it doesn’t really understand how a business works, the rules it must follow, or what could break years down the track. The real risk for big software companies isn’t that AI replaces people, but that poorly supervised AI-written code creates messy systems that are harder and more expensive to support, fix and update. While faster development can boost profits in the short term, it can hurt long-term value if the software becomes difficult to maintain, customise or trust.

High-quality incumbents are likely more insulated than threatened: their moat lies in embedded domain knowledge, process depth and engineering processes, with AI acting as a productivity lever rather than a substitute for judgement. Over time, we expect investors to differentiate between AI-enabled but well-controlled platforms and AI-dependent, poorly governed software producers. Disclosure around AI usage, ownership of code and supportability could become a meaningful valuation differentiator, much like cybersecurity and balance-sheet quality today.