Hi Tony,

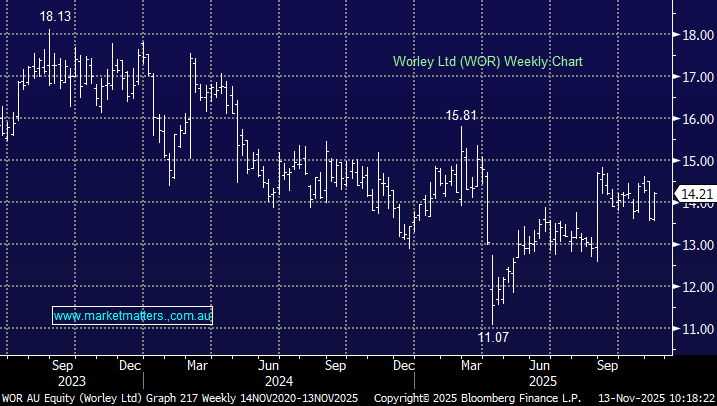

Great question – as a holder of Worley in our Active Growth Portfolio its underperformance hasn’t escaped us. WOR isn’t a traditional mining services business per se with some important differences. It’s a global engineering and project delivery firm that supports miners and energy companies through design, construction, and transition projects. In other words, it sits between resources and renewables, the “brains” behind the big builds.

- WOR designs and manages major energy and resources projects, while more traditonal mining services companies do the on-site work like drilling and hauling.

- WOR is focused on the energy transition and renewables, while mining services remain tied to resource extraction and operations.

MND and NWH are more directly tied to the current resources boom, especially in the likes of precious metals, copper, lithium, and critical minerals. WOR is more focussed on sustainability related engineering and project design. We are questioning whether or not we are on the right horse here. Our thesis was/is around expanding margins on a big base of revenue to drive earnings growth, which is playing out, but not to the same extent as some others.

- We remain long WOR anticipating some performance catch-up.