Hi Carl,

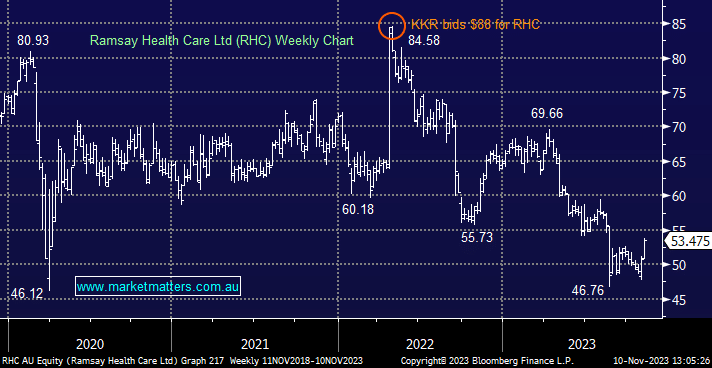

Definitely wishful thinking at our end as we own RHC in our Active Growth Portfolio, the initial KKR bid back in April 2022 was at $88 per share, this was subsequently pulled in August although they left the door open for talks on an alternative proposal, i.e. not all cash.

The sticking point at the time appeared to be RHC French operation, Ramsay Sante (GDS FP), which is still an issue but with RHC trading ~40% below their original bid a revisit would make some sense, especially as the French listed company has rallied ~20% from its late 2022 low – RHC owns 52.79% of GDS.

- We like RHC at current levels on valuation grounds, a takeover is still possible but it wouldn’t be our only motivating factor to own the stock into 2024.