Hi Nick,

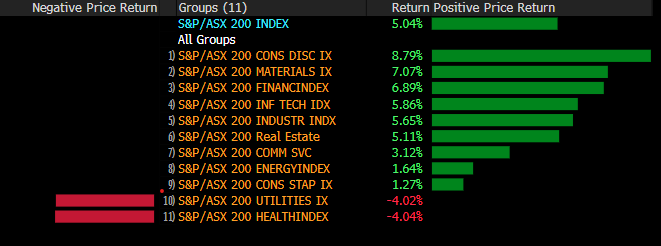

So far in 2025 the market has been driven higher by the consumer discretionary +8.8%, Materials +7.1%, and Finance Sectors +6.9%, in other words the heavyweights. From a points perspective this can be highlighted by the markets largest 3 stocks, all from groups which exert the most influence on the ASX:

- Commonwealth Bank (CBA) +8.8%, BHP Group (BHP) +3.6%, and National Australia Bank (NAB) +11.2% – year-to-date.

The logic behind the respective moves are straightforward although the gains have been magnified by the ongoing momentum trade stretching the valuations of the markets top performers ever higher:

- An increasingly dovish RBA has added a tailwind to the consumer discretionary and finance names – futures markets are looking for three 0.25% rate cuts by the RBA this year.

- The miners are gaining strength on the combination of increasing optimism towards China and an underweight market, the more they shrug of tariff concerns the better they look.