Hi Scott,

We never consider our entry price into a stock and with MIN, that approach would be folly as this particularly bad result unravels. The saga continued on Friday with more related party transactions coming to light. While this reads poorly and speaks to a wider issue around governance, our thinking here is as follows:

The transactions had been approved by the board, so this is a disclosure issue, nothing more, which can be rectified. If the accusations are more sinister (misappropriation of company money), then Ellison has a big problem. Whatever the case, MIN has lost investor trust and they are now under intense pressure to get it back. We would expect wide ranging changes around governance to appease large investors.

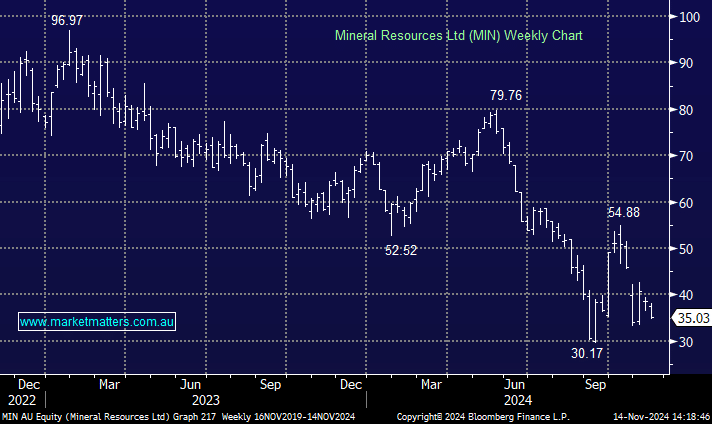

At this stage, price action is poor, though it remains in our $30-50 targeted trading range. We are likely to cut this position and move on, its just a matter of how much we lose and where we reallocate the funds, i.e. a pragmatic /realistic approach.

- In terms of when/where we sell we are watching the stock very closely.