Hi Karl,

I wouldn’t be too hard on yourself when it comes being a “an average” seller, its without doubt the toughest part of the process for virtually all investors. Our thoughts on the two stocks mentioned:

Woodside (WPL) $27.95 – traded ex-dividend this week rewarding shareholders with a 69c fully franked dividend. However we wouldn’t be chasing WPL at this stage for its next dividend in August, there’s no rush with crude oil feeling ready for a decent pullback i.e. be patient + of course there will be BHP shareholders given WPL shares in May which means there could be some additional selling pressure.

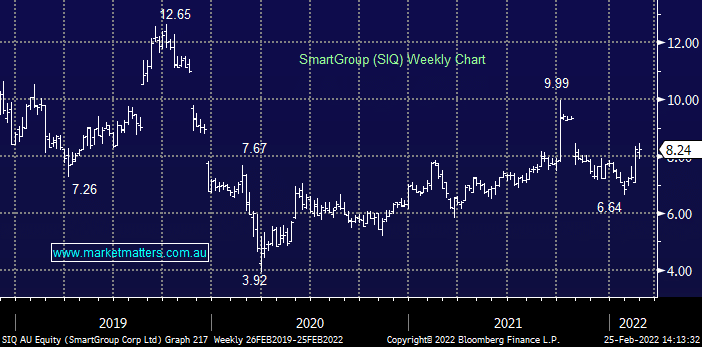

SmartGroup Corp (SIQ) $8.19 – trades ex-dividend 49c fully franked (final & special combined) in early March and we like this stock at current levels from an income perspective – MM actually holds it in our Income Portfolio and we still think it’s one to buy.