What to do with some speccy’s?

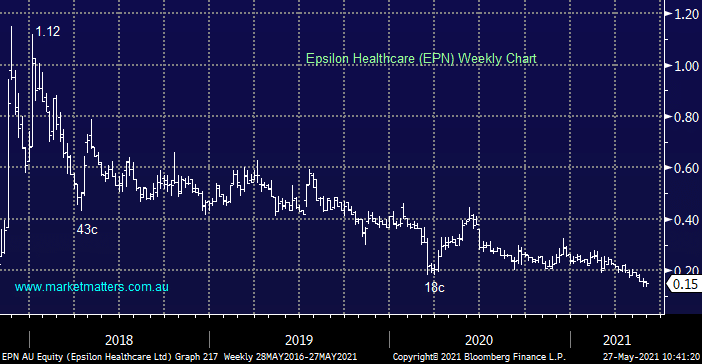

Hello, Newly subscribed member here. I noticed that you run with questions on a certain day. A few years ago I bought a few speccy stocks which I thought would do well, unfortunately, some didn't do as well as I had hoped. Luckily; they were very small positions which I spread across quite a few stocks. I still feel that they should be doing better than they have, but would like your opinion, I have considered adding to them to average the cost down. EPN: This is by none, the worst performing stock I have ever purchased, I bought at 0.54. It seems very oversold to me. BVS and BPT have also been poor performers for me. I purchased just before covid hit and didn't sell. My attitude was that everything would blow over in a couple of weeks. How I was wrong with that! - Regards Simon