What are your thoughts on Dicker Data (DDR) and ASX pure copper plays?

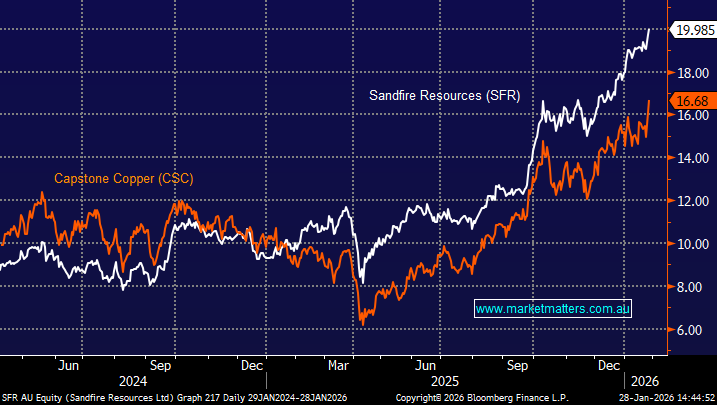

Dear team, Please forgive me for asking questions 2 weeks in a row. The Christmas break and the turbulent times we live in have created a backlog of worry. 1. You recently sold out of DDR. I notice you never had a very big stake in this company, and you considered it high risk. Did you sell because you thought the risk was too high or because it had run its course with little room for growth or possibly for many reasons? 2. I have long considered BHP to be a way of covering Copper investment, but, both BHP and RIO are perhaps 'pulled back' by being mostly iron ore vendors. What would you consider to be the best ASX pure copper play around? My instinct learns to SFR, but others have suggested CSC or DVP might be overlooked gems and no doubt there are others I know nothing about. Thank you for your ever wise counsel, Octogenarian