Thanks Ben – it’s a labour of love!

WA1 Resources Ltd (WA1) is a mineral exploration company focused on niobium (Nb), with its flagship Luni Project in Western Australia’s West Arunta region emerging as a globally significant discovery. Still in the pre-production stage, WA1 is advancing resource drilling and early development while facing typical exploration and infrastructure risks. This $1.5bn business has enjoyed the recent resurgence in rare earths with niobium a critical mineral used in high-strength steel, aerospace alloys, and emerging battery tech.

WA1 will remain unprofitable in FY 26, with a modest turnaround and breakeven / slight profit forecast for FY 27. Almost 90% of Nb comes from Brazil with Canada basically supplying the balance. The WA1 mine is in WA which is good from a geo-political perspective but not necessarily productivity. WA1’s ambitious goal is 20‑25% of the market, assuming the forecast of production and demand estimates both hold.

- Nb is used primarily in high-strength low-alloy (HSLA) steel with growth in EV batteries, superalloys and quantum computing components – no foreseeable Moat issues on the demand side, in terms of supply the greatest issue could be their forecasting.

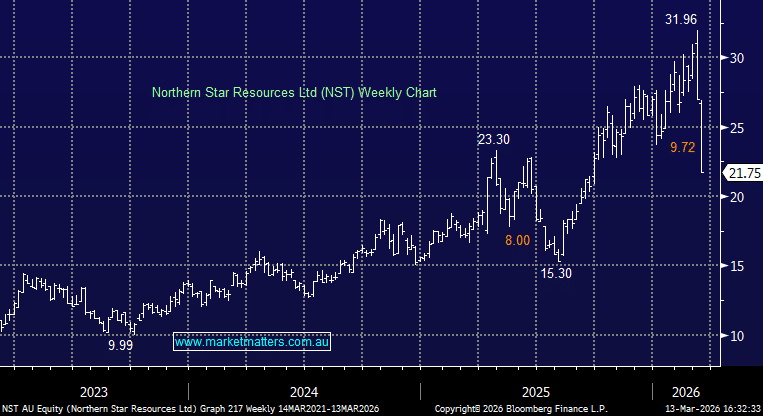

Technically, the stock looks to be breaking out, with decent momentum, setting up good risk/reward by running a stop loss on a close below $18 initially.