Hi Alan,

To a degree when you look at performance it can depend on where you draw the line in the sand from a time perspective, see the comparative performance at 10.30am on Friday morning:

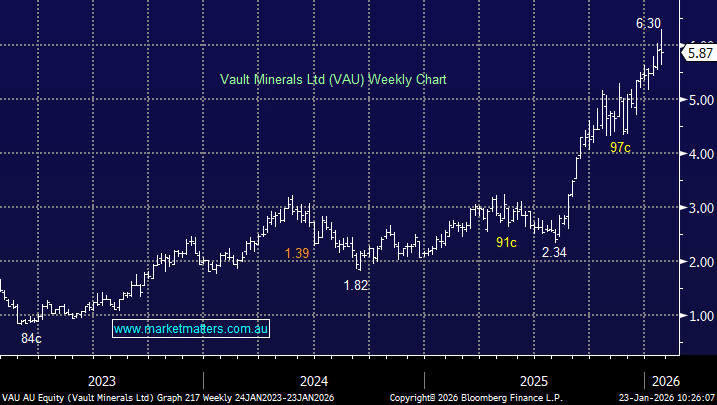

- Over the last 3-months RMS is up +38% and VAU +28%.

- Over the last 6-months RMS is up +74% and VAU +125%.

- Over the last year RMS is up +107% and VAU +140%.

We think VAU has been a net outperformer but like the sector is likely to be at the mercy of the gold price through 2026 with this week’s quarterly leading to downgrades from a number of analysts likely to see some profit taking/switching after its stellar 6-month move. We have turned more neutral Gold right now after a huge run, and we’d be reticent to put new money in the sector unless we see a decent pullback.