Hi Jamie,

As another client put it this week, ‘I wouldn’t leave my handbag unattended in a room with him, now he has the keys to everything’!

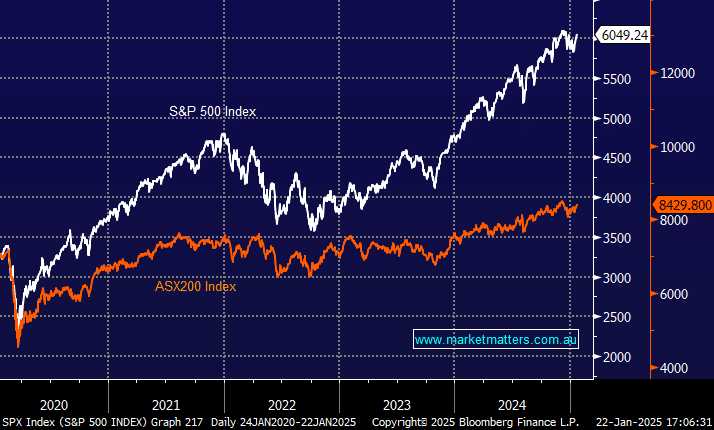

Like him or loath him, Trump is good for US growth. Make America Great Again (MAGA) is more than just a slogan and is being backed up by supportive, pro-growth policies. This feeds into corporate earnings growth and share prices follow earnings over time. US quarterly earnings, while only early days, have been strong, and when we overlay this with further central bank easing, we think a positive bias overall towards America makes sense.

US stocks currently dominate global equities, making up ~70% of the MSCI World Index, and technology is central to that. The Magnificent Seven are now over 30% of the mainstay US S&P500, demonstrating the huge influence of US tech, it’s hard to ignore. We do see the benefits of having international exposure, and this can be achieved through various ways.

Our general preference is through direct equities as shown through our International Equities Portfolio, which is open for investment for wholesale investors through our Managed Discretionary Account offering (via Shaw). We do hope to launch this portfolio in the coming months for retail investors through Market Matters.

In terms of ETF’s, the broad index on the S&P 500 from iShares (IVV) is a staple, though it is now very tech dominated. More specific sector ETFs can be used to construct a more tailored approach, for example, to gain exposure to U.S financials which should continue to benefit from deregulation and are significantly cheaper than our own, specific ETFs can be used to gain exposure to that theme, the iShares U.S. Financials ETF (IYF) or the ASX traded BetaShares RBTZ ETF are examples.

In terms of timing, there’s likely to be times in 2025 when markets get concerned about tariffs and subsequent trade wars and buying US stocks at all-time highs when the AUD is plumbing ~62c is a challenge, and ideally, we’d suggest trying to finesse the timing of making new overseas allocations. Happy to talk to you further about this Jamie!