Thoughts on US tech

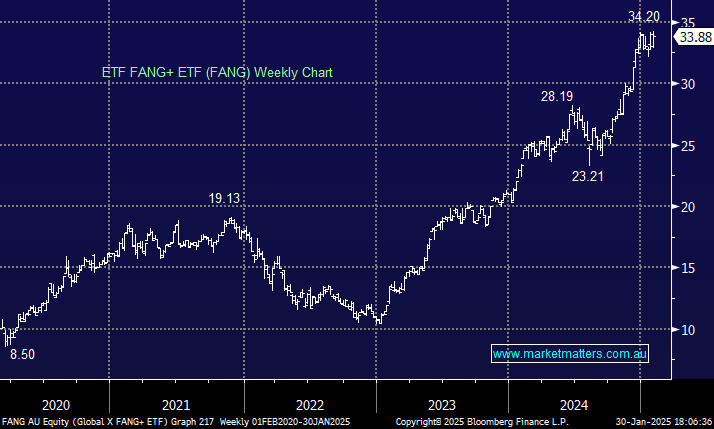

Hi Guys, Happy New Year! I know we aren't meant to say it after Australia day, but given this is my first question for 2025, I wanted to wish you all well for the coming year! I read with interest your view on the recent US tech sell down in this morning's report, noting that you think it is too early to buy the dip. But, given that US tech has surged more than 3x since 2022, and with upcoming volatility expected, is 2025 the year of underperformance for US tech? Is it time to trim or sell some of these stocks/the fangs? Cheers, Josh