Hi David,

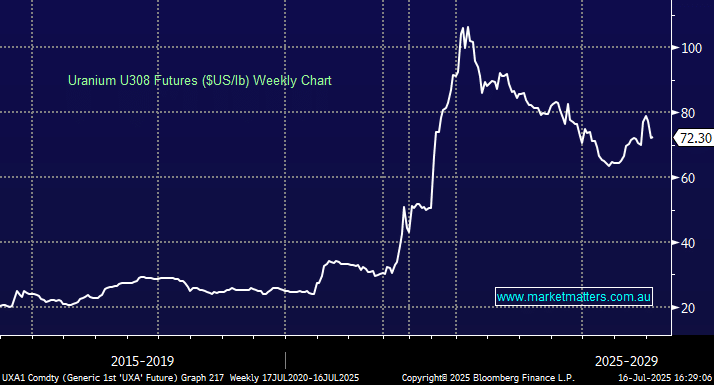

Uranium: We don’t agree with this surplus outlook , we actually believe the opposite is true over the coming years. We continue to read multiple headlines about the growing use of nuclear energy to decarbonise power grids and power surging electricity demand from the tech industry. Thirty-one countries currently operate nuclear power plants, which combined produce about 9% of the world’s electricity, amounting to almost a quarter of all low-carbon power globally. More than 30 other countries, most of them in the developing world, are considering or already embarking on the introduction of nuclear power and are working with the IAEA to develop the necessary infrastructure to do so safely, securely and sustainably.

This week Meta has announced that it will be building a 5GW AI data centre called Hyperion in Louisiana. Mark Zuckerberg claims that the Hyperion footprint will eventually be larger than Manhattan. Meta is competing with other major tech firms (e.g. Google, Amazon, Microsoft) in an AI arms race, and the US is competing with China. Some experts are now suggesting that AI and data centers will account for ~20% of US electricity demand by 2030 (from 2.5% today). This level of electricity demand could create major issues on power grids. Where is the power going to come from if fossil fuels are out, and intermittent renewables are unsuitable? It has to be nuclear.

- At MM we believe a uranium super cycle is just beginning as unprecedented demand gathers momentum over the coming decade.

PM Gold: Perth mint gold is a Call Warrant – not an ETF. There is nothing wrong with it’s structure, being a liquid and easy way to trade &/or invest in physical gold, as you say costs are low at 0.15% while its market cap of $1.2bn illustrates its liquidity. The GOLD ETF we hold in the MM ETF Portfolio is an even more liquid gold ETF with a market cap of $4.6bn, this ETF is backed by physical gold with no credit risk, although costs are higher at 0.40%. We hold the ETF, not the Warrant.