Hi Young,

As you say a lot of questions wrapped in here so please excuse the brevity:

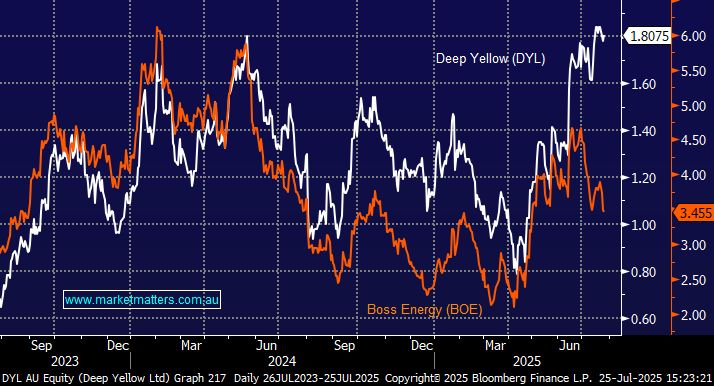

The uranium space has been an operational land mine at times, just look at some of the ASX performances in 2025:

- Deep Yellow (DYL) +58.4%, Boss Energy (BOE) +45.7%, NexGen Energy (NXG) +3%, and Paladin (PDN) -4.5%.

We have looked at NXG. It’s a huge resource and is on it’s way to production soon. Final federal approval is pending a Commission hearing, likely late this year which would open the door for first production late 2028 or early 2029. At this stage, we prefer the producers, but NXT is clearly a bigger bang for buck approach. We are ultimately bullish believing it will make new highs above $14 through 2025/6, initially targeting 25% upside.

We remain cautiously bullish towards iron ore (Fe) but we expect some consolidation in the $US100-105 area by the December contract over the coming weeks – its primarily about what Beijing says next on this one.

Australian Strategic Materials (ASM), a timely question with the stock going into a Trading Halt, on Wednesday, at the request of the company pending the release of an announcement by ASM. No news at the time of answering the question but its recent trading update showed cash flow remained on issue for the $145mn rare earths company which is in a early-growth/loss phase, combining project-level R&D and rare earth refinement operations.

- ASM reported a net loss of $13.96 million for 1H FY2025.

- The company is burning $1.4-1.5mn per month hence its recent ~$12mn capital raise.

Its early days for ASM but it’s worth watching at this this stage of its evolution, noting, we are not really across this company.