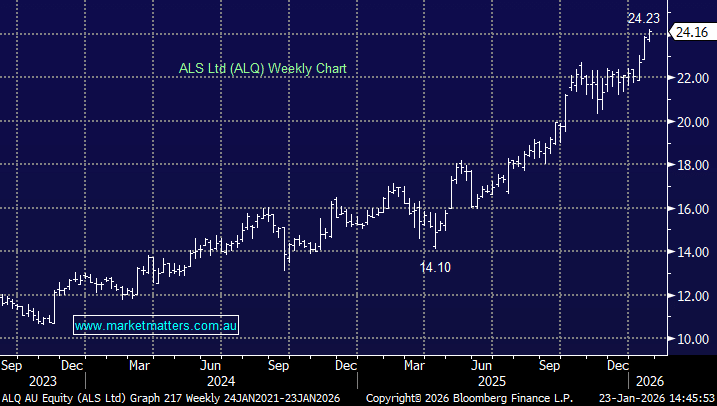

Updated view on ALS Global (ALQ)

Happy New Year MM! Hope you all had the chance to recharge batteries and enjoy a well deserved break. I hesitated to act on silver and feel it is too late to act now (though some say the party has just started). And although I have gold exposure, my weighting has proved to be way too conservative. So, I've been looking for alternative ways to gain exposure to precious metals, and that's how I came across ALS Global. This is a business I have never analysed before, so I would greatly appreciate your view on it. Thanks, Angela