Hi Darren,

The cooler and drinkware maker reported Q3 results this week ahead of expectations and raised guidance for its full-year earnings. There is a bit to unpack with YETI, so we’ll cover earnings first then focus on what a Trump Presidency could mean given YETI manufactures in China.

- Q3 Sales of $US478.4 million were up +10% YoY and ahead of $US471m expected, underpinned by a 30% increase in sales outside the US i.e. the brand is building momentum outside its core market i.e. in Australia.

- This drove a 6% beat to earnings with underlying EPS of 71c up from US60c YoY and ahead of US67c consensus.

- Direct-to-consumer sales were strong at $US280.8 million while wholesale sales were $US197.6 million, with Drinkware sales making up ~57%.

- They also mildly increased FY guidance to underlying EPS of $US2.65, at the top of their previously guided $US2.61 to $US2.65 range.

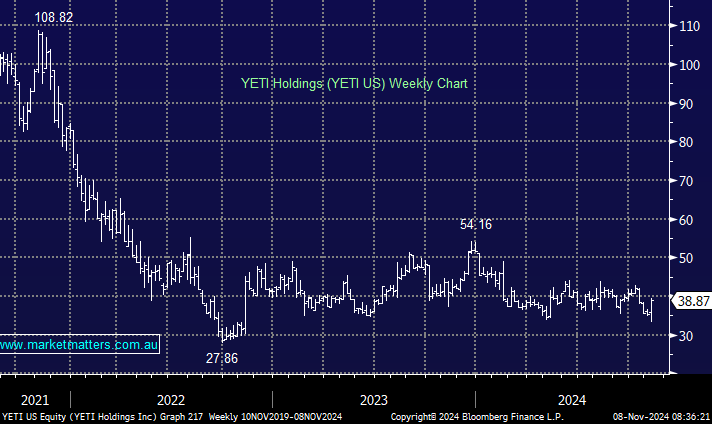

During the campaign, Trump said he would apply a 10% duty on imports in general and a 60% duty on goods coming from China – YETI manufacturers in China. They are deviating from this strategy though, and by the end of this year, approximately 20% of Yeti’s global drinkware capacity will be located outside of China, with a target of 50% by the end of 2025. Obviously, the impact of potential tariffs and how they will be enacted in practice will be important for YETI and others, however in MM’s view, the stock is priced for these risks.

Trading on an Est PE of 14x puts it on a ~10 PE point discount to the broader market, with earnings expected to grow 20% in FY24 & the same in FY25. A quality, growing brand, with a fantastic direct to consumer sales channel, with products that consumers love, trading on a material discount to the market, we think is very attractive, and we maintain our positive view.