Hi Darren,

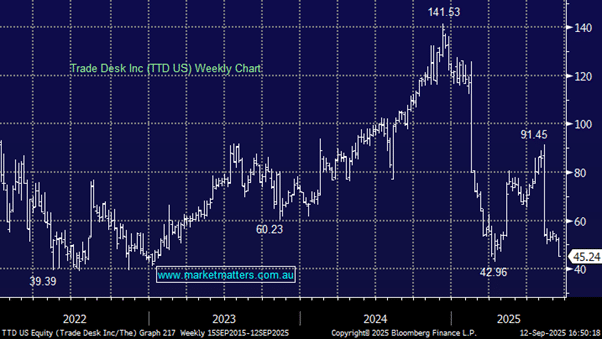

TTD has been sold off recently due to a rare revenue miss, cautious forward guidance, and increasing competition, particularly from Amazon’s DSP in the connected TV space. Investor concerns have also been fueled by macroeconomic pressures, advertising budget cuts, and some execution challenges, including delayed product rollouts and a CFO transition. With the stock previously trading at high valuations, the modest underperformance has triggered a sharp re-rating with the stock now trading more than 50% below its average valuation over the last few years.

If we didn’t own, we’d be waiting for the next quaterly before making any decisions, with execution (especially rollout of Kokai, securing more brand‑direct business, and proving growth in spite of competitive pressure) being very important. As you said Morgan Stanley downgraded TTD from Overweight to Equal‑Weight, cutting its price target from $80 to $50, citing weaker momentum in core markets but the stocks now ~$US45!

- Many in the market are deliberating whether TTD’s model is broken, hence we are deciding whether to hold until the next quarterly or to scratch our position and reassess. We originally bought TTD at $42, and unfortunately, seen a lot of open profit evaporate.