Hi David,

For obvious reasons we don’t, or attempt not to, pass political views at MM instead focusing on the underlying stock market, as the saying goes stick to your knitting!

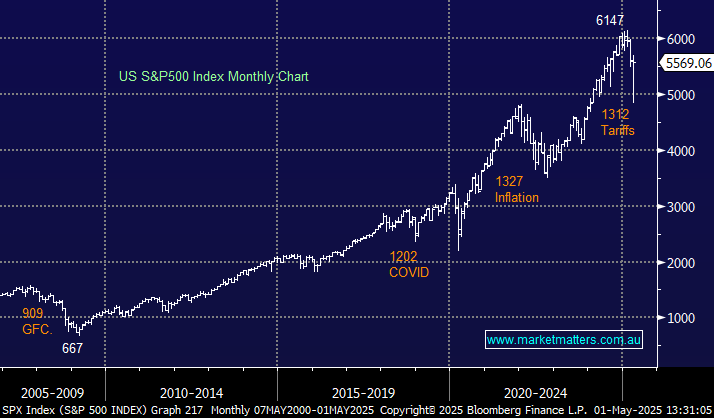

We’ve copped a little heat from subscribers through March/April by remaining net bullish equities into weakness although “Liberation Day” did create a sharper correction than we initially expected. However, the money flow back into stocks is telling us that until further notice the bull market is alive and well with the “tariff correction” and almost carbon copy of the “inflation correction” back in 2022.

Our interpretation of tariffs simplistically, is they are very bad policy. They won’t work and globalisation has so many more benefits. If they are bad policy, and we think that is so, they must be a strategy (not a policy) and this we think is the more likely scenario. They are being used as a negotiating tool to get a better outcome for the US, and we tend to agree that the US does bear a disproportionate amount of global ‘costs’ when it comes to things defence, and this needs some attention. We firmly believe it is not in America’s interest to be the catalyst for a major global downturn.

- Our preferred scenario is the US S&P500 makes new all-time highs into Christmas helped by the pending interest rate cuts, tax cuts and general deregulation – three major tailwinds for stocks, one tariff negotiations are finalised.

We believe the US will avoid a meaningful recession although the short-term impact of tariffs may generate a technical one. We believe 2025 will provide plenty of excellent investment opportunities for Active Investors, it’s just a matter of being on the right side of the stock/sector swings – always easier said than done!