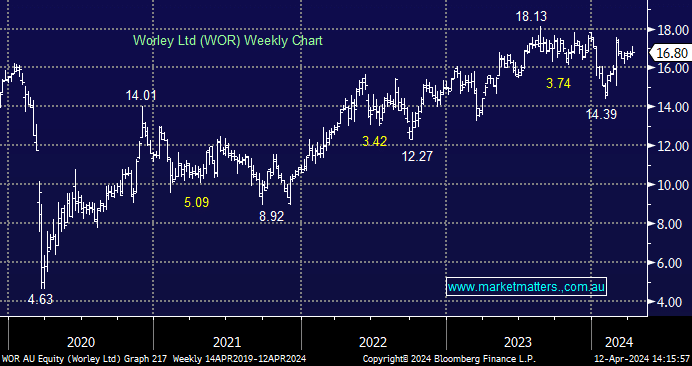

Thoughts on WOR and ACF

Good morning James and team, First of all I want to thank you for the great information and insights you provide on a daily basis. I'm very sure the best investment I did by far in the last few years was to subscribe to MM. Today I'd like to ask about your thoughts and price target on WOR (given that you already own it) and what is your view on ACF and what would be your entry point. Thank you so much and have a great weekend