Thoughts on ILU spin-off, Deterra (DRR)

Hi James and Team .

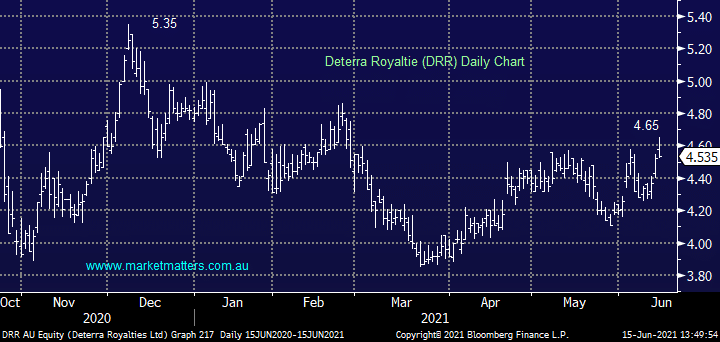

Thanks for your ongoing commentary, website is working well and your new podcasts are great - I recently topped up on ALU following your review. I would appreciate your view on DRR, demerged from Iluka in November 2020. This mining royalties business looks really interesting with potential capital growth and dividends as the global growth continues and infrastructure investment increases. Any reduction in the iron ore price should be mitigated by these factors . General advice only.

Thanks David P.