Thoughts on hybrid ETFs

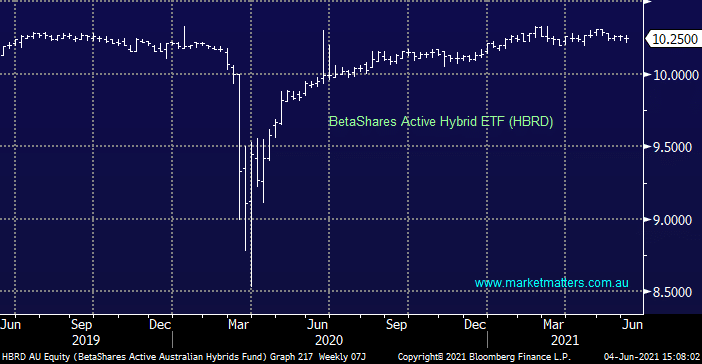

Hi MM, Reports have been great. Frustrating no dip in May. Probably the next big one in September now? I was interested in your report about the new ANZPI and was wondering what you thoughts are on the active and now a new passive ( lower fee) ETF for the banking hybrids, HBRD and BHYB ? Cheers, Jill