Thoughts on commonwealth bank (CBA)

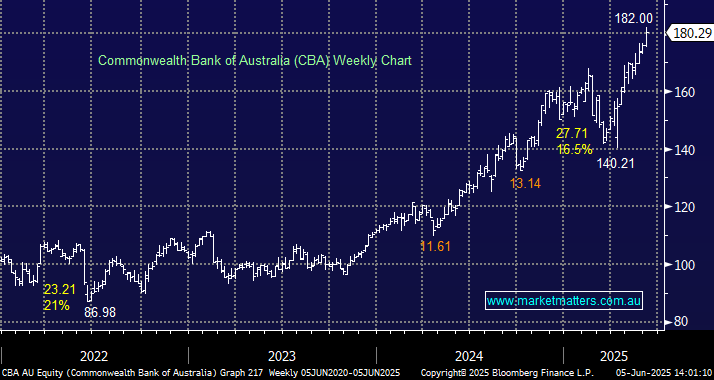

Hi MM I've been a member for a number of years now and have enjoyed the market coverage you provide and the different portfolios that members have access to in real time. I have found this hugely beneficial. My question is around CBA; I have been slowly setting up my portfolios to mirror those at MM and when I initially invested in CBA for my income portfolio, I only had a 1% weighting vs MMs 5% weighting. I can see in the Income Portfolio on the MM website that it shows CBA is still considered 'Active' even though the current price is $180.46 vs $61.33 at the time MM purchased the CBA shares. I realise you can't provide individual advice, so I am just seeking MMs thoughts as to where CBA is headed? The last update from MM was on 20 May 2025 "We can see CBA testing $180 in 2025, but the outperformance feels stretched". As CBA hit a new all time high today of $181.39, is MM still long and bullish? Thanks SB