Hi Adel,

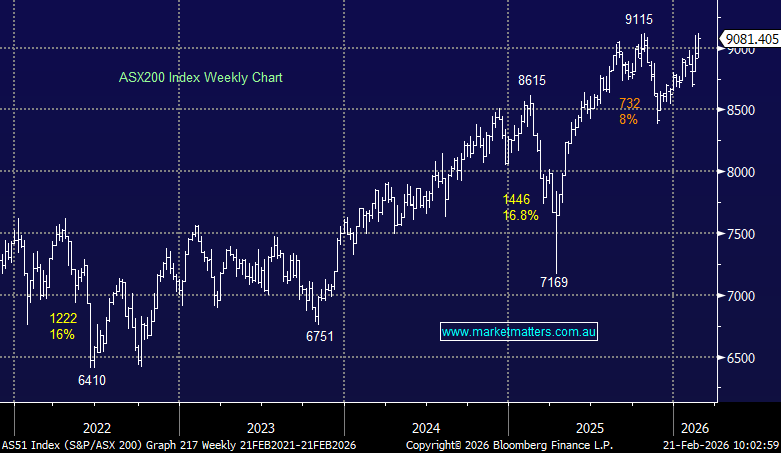

As the market surged above 8700 on Friday afternoon our favourite two ASX banks, Westpac (WBC) and ANZ Group (ANZ) were up 1%, or more. The market broke out to fresh highs with our initial 8800-9000 target area coming into view – investors and traders alike should always remember that surprises usually occur with the trend which in the case of the ASX200 is bullish.

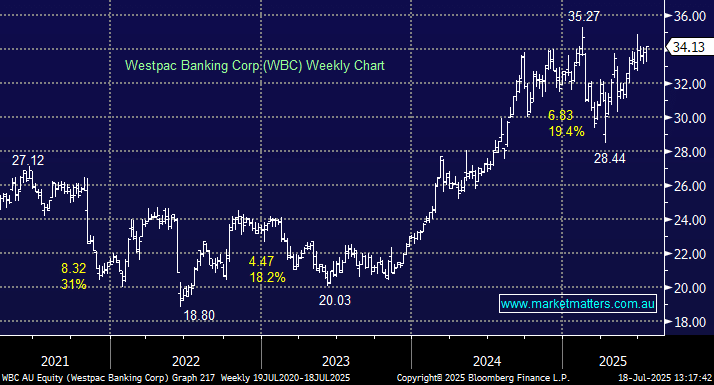

While seasonally August and September is a tough time for local stocks there’s still two weeks left in July……the market might pop another 5% this month before retracing some of its gains in the following two months, aligning the seasonal’s but making entry still tough. Our core view is we remain bullish over the coming months but the journey is a more tricky call. In the case of ANZ and WBC we are looking for further strength with their dividends looming in November:

- We remain bullish ANZ and WBC initially looking for an additional 5-7% upside hence we aren’t planning to trim and re-enter our positions.

Its always hard to buy strength although we believe its smarter than than buying new lows. In terms of HLI it appears that a number of subscribers followed us here demonstrating that investors like a “bargain” which as we just said is a dangerous game. We can see HLI rotating between $5 and $5.50 for a while but we are looking for yield more than capital gains after the stocks 30% bounce.