Thoughts on AAIG & Halo?

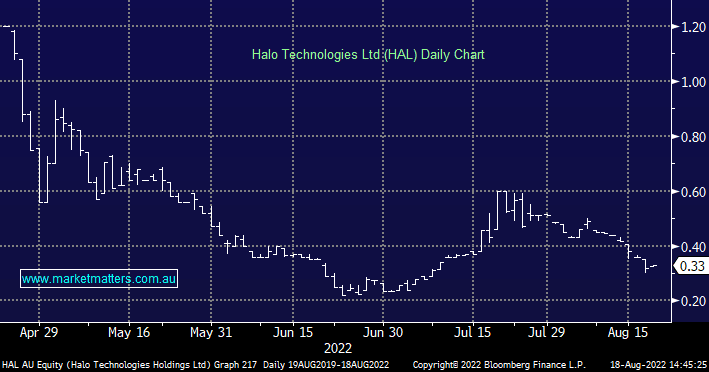

I have just read your reply to Michael RE Halo IPO whilst researching the inner workings of AAIG. I became an AAIG shareholder in March 2020 after ASRW sold me on the idea with a 30% guaranteed return on investment via a deed poll with ASRW underwriting the AAIG IPO for 35c a share. ( purchase price 27c a share). I had just signed up to ASRW. That capitol raising was for 7 mill. (6 or so months later I came across another similar AAIG capitol raising proforma this time for 15m). So far no AAIG IPO but their flagship HALO business has had its IPO listing just recently. HAL Down 25% day 1, down 50% by day 4. The HAL IPO issued me with about 12000 shares at the full pre IPO price of $1.20 which came out of my AAIG capitol input since my AAIG shares were then devalued from 27c to 19.6c. My 2 questions: Can AAIG be considered to vaguely represent a SPAC (Special Purpose Aquisition Vehicle type company? and With AAIG financial returns indicating 5 - 6 mill losses for the past 3 years at least and a deed poll underwriting a 35c share price on a now 20c share (75% profit) , what is the likelyhood or (was there ever) of an AAIG IPO? Thanks