The recent call on Commonwealth Bank (CBA) in the Income portfolio

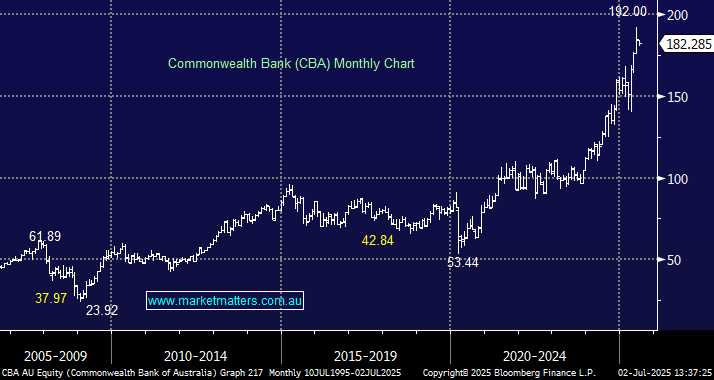

Hi MM team, I found your call to potentially sell CBA from the Income portfolio very interesting. Interesting because I sort of have a similar quandary regarding my holding of DBI. MM's CBA investment pays a 7.7% dividend that is fully franked (div/entry price). I have read and I think I understand the rhetoric about CBA and its lofty price but it's a comfortable cashcow. Please can you explain why MM is looking to potentially sell. Does MM have a replacement investment of similar ilk in mind (income and risk)? Or is it just a funding vehicle for the next buy? Thanks and regards, JanP Hi MM, It's more a comment than a question. I appreciated your recent comments on CBA. I unfortunately listened to too many sell-side analysts and took the opportunity to get some extra income from CBA by selling covered call options. Whilst initially out of the money, they are now well in the money so could lose them when they next go ex dividend in August. My options (no pun intended) to keep the shares are to buy out the contracts or roll them over, both at a cost to me. Otherwise, I'll take solace in the knowledge that no-one ever went broke taking a profit. Cheers Peter No jeers from us on selling CBA - go for it!- Karl