Hi David,

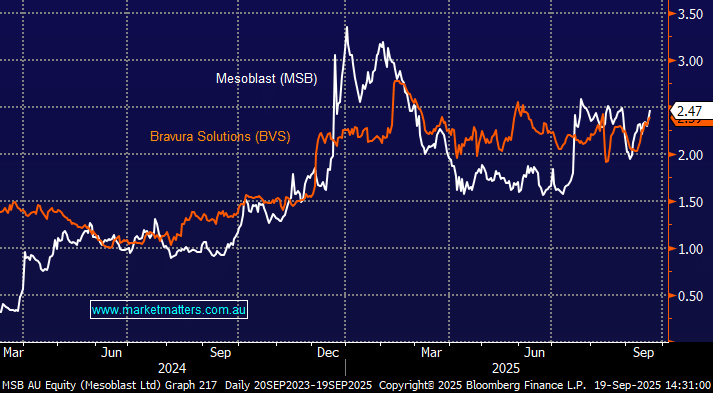

Two very different companies here even if their charts are similar. We note that charts do often tell a tale but they are never the sole reason we use to buy or sell a stock.

Mesoblast (MSB) is a biotechnology company developing stem cell, based therapies for inflammatory diseases, cardiovascular conditions, and orthopedic disorders.

- After a tough first half of 2025 we think MSB has turned the corner following its strong quarterly update in July showing early commercial traction for its recently launched FDA-approved therapy Ryoncil, along with expanding payer coverage and solid financials.

- In August it announced FY25 revenue of $17.2mn up from $5.9mn in 2024 with estimates of ~$68mn for FY26.

- We like the risk/reward towards MSB below $2.50, initially targeting $3.

Bravura Solutions (BVS) is a fintech / financial-software company that builds and supplies administration, management, and back-office systems for the wealth management, superannuation/pension, life insurance, funds administration, advice, and transfer agency sectors.

BVS rerated on the upside in December 2024 and February 2025:

- In December, BVS raised its financial outlook for FY25, increasing expected revenue, EBITDA, and cash EBITDA targets. The company also announced it would resume paying dividends (after a pause) and committed to a capital return to shareholders, signalling its confidence in cash flows and financial health.

- In February, its 1H25 results showed a sharp turnaround with large improvements in EBITDA, cost controls, improved margins , while moving from loss to profit.

We are cautiously bullish towards BVS ~$2.40 with a test of $3 not off the table if it maintains its recent momentum.