Hi Albert,

A great question which I’m sure a number of subscribers have also pondered.

Two months ago most people we spoke to wanted to buy quality stocks like CBA, JBH and ALL but they believed they were far too expensive. By definition to get such names 20-30% lower investors needed their confidence to be rattled and in this particular case it was by Donald Trump and his tariffs.

- Human emotion is a shocking investor, it gets sucked in by “Fear of Missing Out” (FOMO) while being scared to buy when bargains emerge.

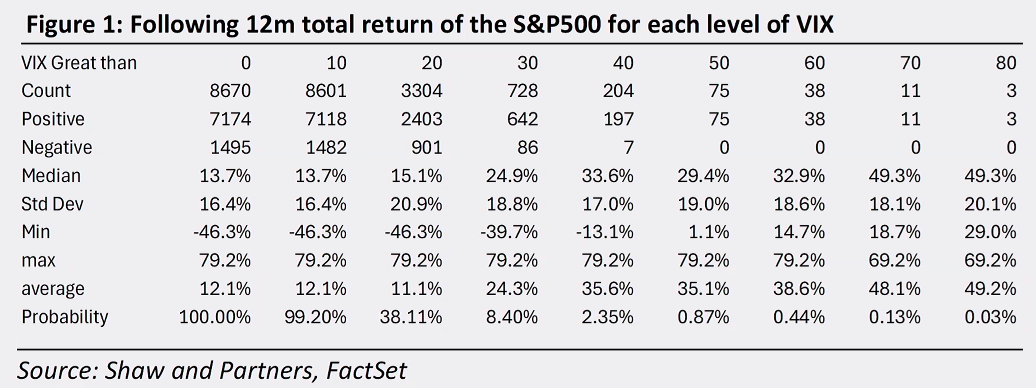

The chart below we included in a report earlier in the week illustrated the excellent average rate of return and strike rate when the S&P500 experienced panic as we’ve seen in recent times, and especially on Monday. Already, come Wednesday US stocks had already surged 13~% from their Monday low, retracing almost half of the losses since their February highs.

We continue to believe the local market will see out 2025 above 8000 helped by lower interest rates and an economy which doesn’t fall into a recession. If this view changes we will rapidly migrate down the “risk curve” increasing our cash position.

- The simple answer to the second part of your question is yes we will consider moving to cash but we will always hold at least 80% of our Active Growth Portfolio in Australian stocks, in line with our Managed Portfolio mandates.