Hi Marg,

Two very different companies here, I even wondered if you had one of the stock codes wrong!

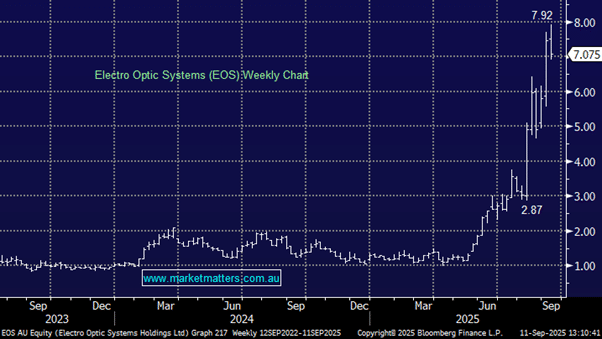

Electro Optic Systems (EOS) – has surged over 5-fold in 2025, back in July we preferred EOS over DRO when it was trading at $3.70, we should have made that call from the rooftops with the stock almost doubling while DRO is up ~15%. This Australian defence and space technology company is operating in a very “Hot” space at present, including remote weapon systems, counter‑drone solutions, and space surveillance and tracking equipment, with volatility surging along with the share price.

- We like the risk/reward towards EOS around $6.50 but this may increase if they win more contracts on top of the ~$180mn out of Europe this year.

Sun Silver Ltd (SS1) – A $161mn recently listed mineral exploration company focused on developing its flagship Maverick Springs silver-gold-antimony project in Nevada, USA. It holds a large, inferred resource and is advancing through drilling and feasibility work, with antimony emerging as a potential value driver – the second time we hear antimony in one Q&A.

The stock has traded in very choppy fashion since it listed in May 2024, with a low ~40c and high ~$1.10. It’s not for us at MM due to its size and liquidity but the more the critical mineral comes into focus the greater the chance of a decisive breakout above $1, potential interesting for high-risk traders.