Something a little different – Cocoa

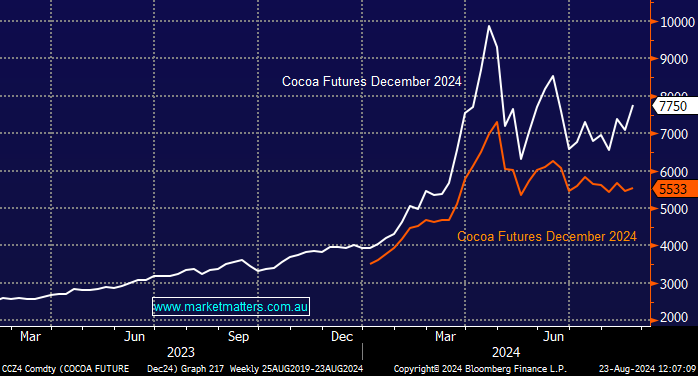

Hi guys, just to give you something different and keep you on your toes. Hopefully you won't be bitter over it, excuse the pun. I stumbled across the swap rate on cocoa beans. Now we all know the price went through the roof at the start of the year, but there still appears to be an issue longer term too and from what I can make out, large crops will need to be re-established which will take a couple of years to get back to full production, that is of course, if no further issues arise. How do you think the price will play out over the next year, and why would there be such a high swap rate currently? I can get ~60% on a long position for London, and ~50% for US. And finally, why is there a difference between London and US prices, surely it it can't be that simple for a arbitrage trade. My fingers are idle and currently have no holdings as I was waiting for September wipe out. It seems the markets happy at these extended valuations across the board, people are still spending as seen with JBH/SUL for example. I had been waiting to jump on some resources, but it just doesn't feel right yet, so looking at different things. Regards, Simon