Hi Stuart,

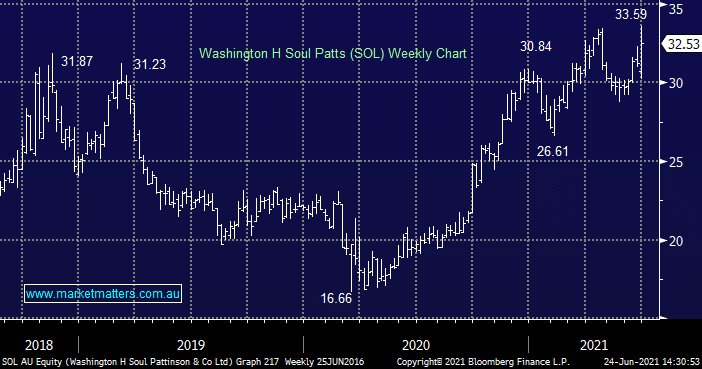

Thanks for the thumbs up, much appreciated! The deal between Milton (MLT) & Soul Patts (SOL) makes strategic sense in MM’s view and will see a bigger, more diversified investment vehicle as a result which will be in the ASX top 50. To your question around when to exit, the deal values MLT at $6 so exiting at least at that level makes sense, plus it’s a 10% premium to their NTA. The deal will likely proceed in our view.

RE RXL, short answer is, I don’t know much about this stock however when in-species happen like this it’s generally pretty value neutral / negative in the short term given the costs of the change and the fact that many shareholders are no longer holding what they originally bought or there is a clear rationale for making such a move (like there was for WOW). They tend to only bear fruit if one or both of the companies kick goals operationally, more so than what is already a known known. The momentum seems squarely on the downside on this one.