Hi Nilang,

We answered a related question around Simandou last week. It’s important to note, that Simandou’ s supply is already priced in, with the bulk commodity trading in a steep backwardation, with analysts’ models already reflecting its impact.

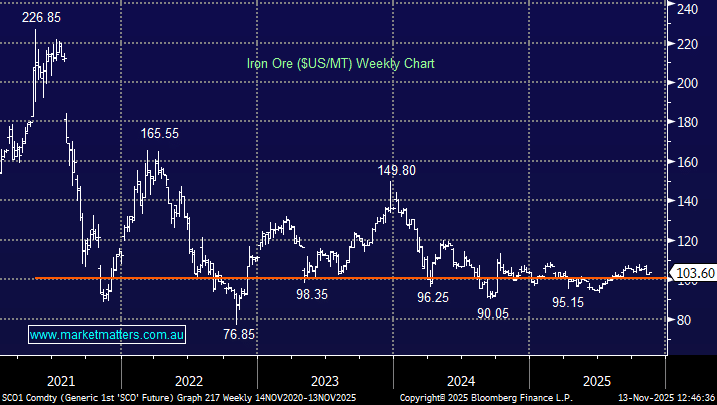

- The December’25 contract is trading ~$US103 and the December’26 contract ~$US94.

NB Backwardation is when today’s price is greater than the future price whereas Contango is when the future price is higher than today’s price.

We believe analysts will be hiking their average valuations across BHP, RIO, FMG, and MIN by at least 10%, all else equal if iron ore can average ~$US100/MT through 2026, it surprised the market with its resilience this year, why not next? We remain bullish on iron ore stocks heading into 2026, believing that analysts are overly focused on a bearish outlook driven by the anticipated supply increases, leaving room for surprises on the upside.