Should I take profit on FMG?

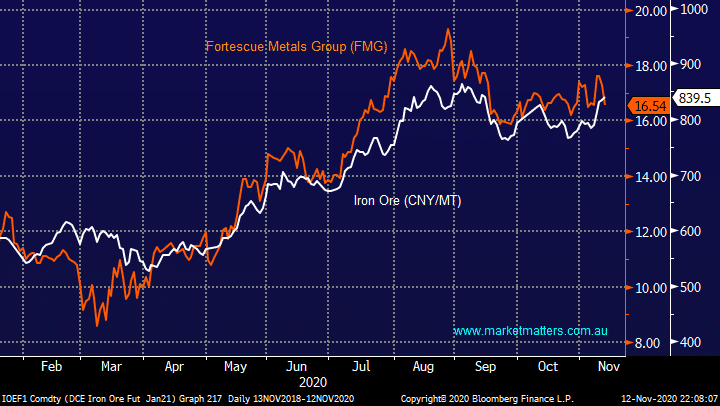

“Team--Thanks yet again for your work-profitable, even in such an ordinary year --and easy to follow. May be already done (I have been out of action for a week or so), but could you pass an opinion on the best thing to do for those of us holding iron ore stocks--particularly FMG, which I’m currently showing 170% profit on? “Let your winners run” may be good advice (it has been for me) , but the China squabbling I’m sure has many investors in the space quite worried. Is it time to cash out of FMG et al and look to re-enter at a later date? -- or are there other overlooked factors in the iron ore market that make holding a wiser option?” - Merry Xmas to all, Paul A.