Hi Alain,

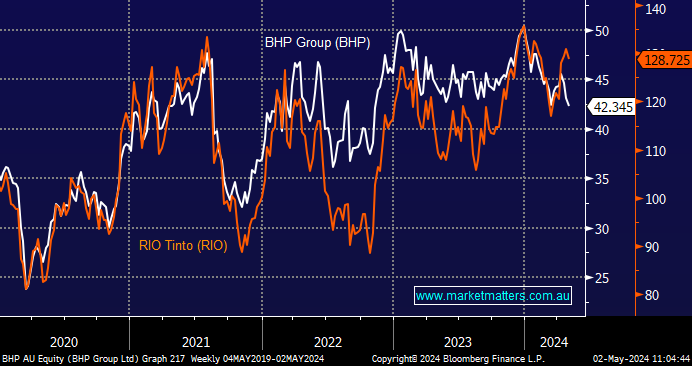

There is a few caveats here but yes we do prefer BHP over RIO assuming it doesn’t overpay for Anglo American (AAL LN) – potentially a big if!

We like the way BHP is evolving their business with a distinct focus on sustainability and especially copper, remember they bought OZ Minerals (OZL) last year and now they are looking at AAL. Also they merged their oil & gas division into Woodside (WDS) in 2022 and sold some major coal assets to Whitehaven (WHC) in 2023, i.e. they are evolving fast.

- If we do decide that RIO is a better investment than BHP it will be reflected in our holdings, at the moment we hold BHP Group in our Active Growth and Active Income Portfolios.