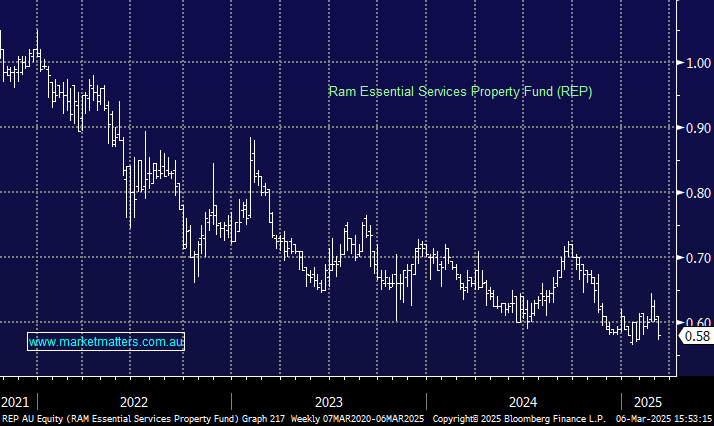

Ram Essential Services Property Fund (REP)

Hi guys Whats your thoughts on rep ? It is a reit that invests mainly in essential healthcare which is a growing sector with our ageing population. It has a nta of $0.88c and is currently trading at $0.59 and they have been buying back shares as a result of the discount to nta. Also in the past 4 years they have paid a dividend of over $0.05c which is over 9% at the current share price. With interest rates now starting to fall this should also be a positive. Thanks Tony