Hi Ray,

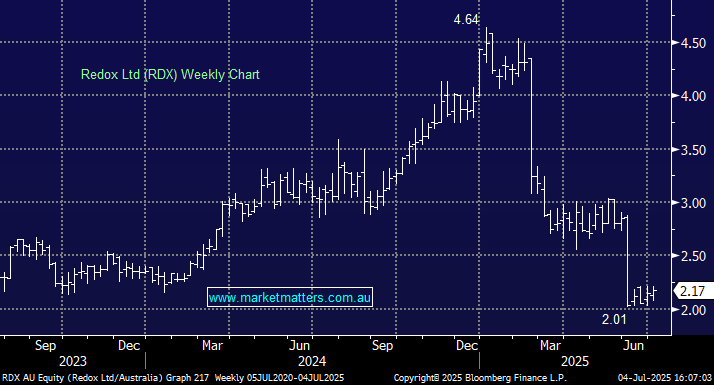

For subscribers not familiar with Redox (RDX), it supplies over 1,000 chemicals and ingredients to industries like food, agriculture, health, mining, and water treatment. The stock listed in July 2023 at $2.25, with the shares embarking on a volatile journey since, it’s currently valued by the market at $1.1bn, trading at $2.16

In 2023, we liked RDX but said “MM is neutral RDX“, we should have been more positive with the stock almost doubling in the ensuing 15 months. However, RDX has fallen around 50% this year after missing profit estimates by around 13% in February, the secondary fall in June is harder to understand and after ASX queried it, the company had no explanation for the sharp decline.

To answer your question, the stock did very little for a long time post IPO before rallying very strongly, then falling off a cliff. Companies like RDX should be a lot more stable than that, which has reduced our interest and our coverage. That said, we think it is starting to look interesting back below the IPO price.

- We think the risk/reward towards RDX around $2 is interesting with the stock trading on 14.9x, below say Orica (ORI) on 18.2x, and its expected to yield over 5.7% in the next 12-months.