Hi Sidney,

I can imagine the two directors that sold ~20% of their holdings each would be kicking themselves given the stock is trading ~50% above their sale price, leaving plenty on the table from the timing of the sale.

There are plenty of requirements for listed companies regarding continuous disclosure and insider selling.

- From the ASX Continuous Disclosure guide available here – Once an entity is or becomes aware of any information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities, the entity must immediately tell ASX that information.

- Insiders (directors, executives or employees) also face restrictions regarding the timing of sale. They must not gain an advantage by selling ahead of negative news flow, or buying ahead of positive news flow that they would be reasonably expected to contain. They also face blackout periods ahead of HY, FY and Quarterly updates.

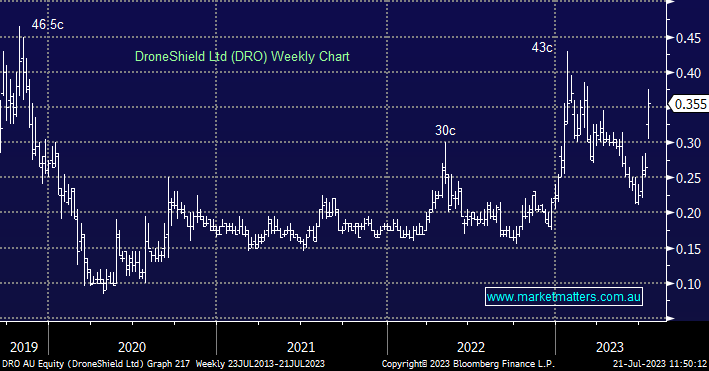

FY23 has been a transformative year for Droneshield (DRO) with demand and production picking up. The challenge will be coming from competitors and being able to win repeat business for the company.