Range of stock market/ real estate related questions

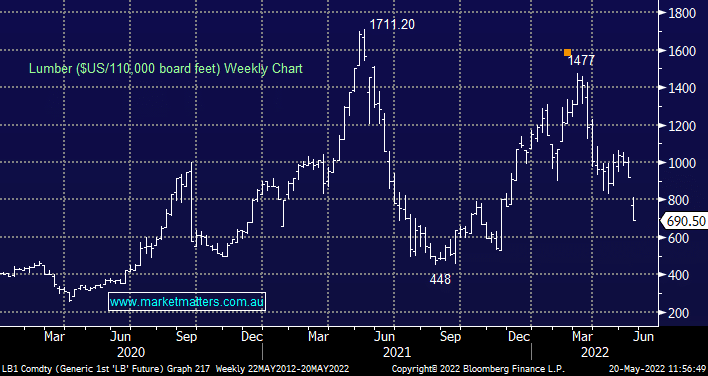

HI MM, Please add these questions to the Sat - Ask James session: i) Can you please comment on the local ETF - FOOD in conjunction to the Thursday morning report. Are there similar food company based ETF offered in the ASX? ii) Lumber prices - it is not being discussed a lot, can you share your insight and direction? Are there ASX companies linked/exposed to lumber prices. iii) Labor's govt - Help to Buy policy ( govt to lend up to 40% ) vs Liberal's policy of tapping into Super. Won't both policies be pushing up home prices? Sounds like one is govt loan and the other is tapping into Super savings. What's your comment? Thanks,