Question on the Income Portfolio & XARO AU

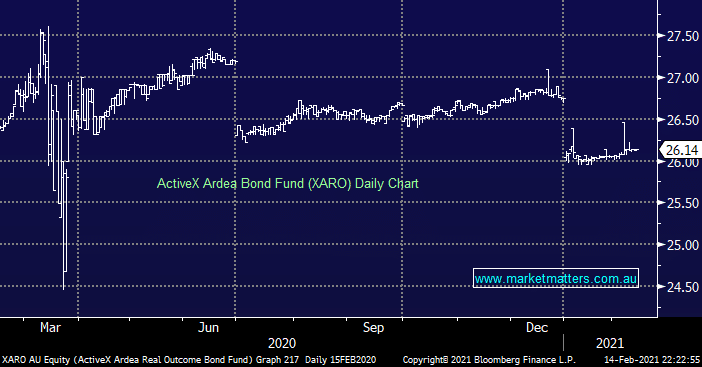

“James & Team Thanks for all the insights over the past couple of years. It has been invaluable for our SMSF. Can you assist with an insight/answer to 2 questions please: 1. The income portfolio discussion states "The portfolio remains well ahead of its benchmark for the current financial year, up 16.01% vs the RBA + 4% target of 2.56%." This implies the RBA is a negative rate. What am I missing? 2 . XARO price dropped at about the same time that it delivered a similar sized dividend. It is now trading within a tight range around the low $26.00s. It remains listed as a Buy in the portfolio and of low risk. Any insights into its outlook.” - Thanks in anticipation Peter S.